71% of Americans are actively worried they don’t have enough money to survive the next recession. Are you one of them—and do you know the strategic money rules for a recession that could change your odds? Mastering recession money tips might be the smartest move you make this year.

I get it. Economic downturns don’t exactly send party invitations before they crash through your front door. But here’s the truth: preparing for a recession doesn’t require an economics degree or a trust fund—just some strategic money rules that actually work.

Whether you’re living paycheck-to-paycheck or sitting on some savings, these recession-proofing strategies will help you build financial resilience when the economy takes its next inevitable nosedive.

The difference between those who merely survive a recession and those who come out stronger isn’t luck or income level. It’s something far more interesting…

Build a Strong Financial Foundation

A. Eliminate High-Interest Debt Fast

Credit card debt is the monster that eats your financial security for breakfast. With interest rates often exceeding 20%, this debt multiplies faster than rabbits in springtime.

Think about it – if you’re paying 22% interest on a $5,000 balance, that’s over $1,100 wasted every year just on interest! Before a recession hits, this needs to be your priority target—and a key part of following strategic money rules for a recession.

Try the debt avalanche method: list your debts by interest rate and attack the highest one first while making minimum payments on others. Once that’s dead and buried, roll that payment into the next highest.

For quick wins, consider:

- Balance transfer cards with 0% intro APRs (watch those transfer fees!)

- Using any windfalls (tax refunds, bonuses) exclusively for debt reduction

- Selling unused items and putting 100% toward your debt

- Temporarily pausing retirement contributions beyond employer match

Your future self will thank you for slaying this dragon first.

B. Create a Six-Month Emergency Fund

The difference between financial stress and financial peace during tough times? A proper emergency fund.

Six months of essential expenses is your recession shield. This isn’t about having money for vacations or new gadgets – it’s about keeping your lights on and food on the table if income suddenly disappears.

Don’t let the big number intimidate you. Start with a mini-emergency fund of $1,000, then build from there. Even $50 a week adds up to over $2,500 in a year.

Where to keep it? High-yield savings accounts are perfect – accessible but not too accessible, with interest rates currently around 4-5% (as of June 2025). That means your safety net actually grows while it protects you—a smart move within any set of strategic money rules for a recession.

The peace of mind from knowing you can survive six months without income is genuinely life-changing. When others panic during economic downturns, you’ll sleep soundly.

C. Streamline Your Budget for Essential Expenses

Recessions are brutal on bloated budgets. Now’s the time to trim the fat.

First, track everything for a month – and I mean everything. Most people are shocked to discover where their money actually goes versus where they think it goes.

Next, use the 50/30/20 rule as your starting point:

- 50% for needs (housing, food, utilities)

- 30% for wants (dining out, entertainment)

- 20% for savings and debt reduction

When recession-proofing, flip that script and see how close you can get to 70% needs, 10% wants, and 20% savings.

The subscription creep is real – those $9.99 monthly charges add up fast. Review every recurring payment and ask: “Would I buy this again today?” If the answer isn’t an immediate yes, cut it.

Meal planning alone can save hundreds monthly. Home cooking isn’t just healthier; it’s a recession-fighting superpower.

Remember, temporary budget tightening now prevents desperate measures later.

D. Automate Savings to Recession-Proof Your Finances

The harsh truth? If you wait until money “feels available” to save, you’ll never save enough.

Automation is your secret weapon. When money moves to savings before you see it, psychology works in your favor – you adapt to living on what remains.

Set up automatic transfers that happen the day after payday:

- Emergency fund contributions first

- Retirement account contributions second

- Short-term savings goals third

Many employers can split direct deposits between accounts. If yours can’t, your bank certainly can schedule automatic transfers.

Create different savings buckets for different purposes – the emergency fund we discussed, plus separate accounts for property taxes, insurance premiums, car repairs, and holiday spending. It’s a practical way to apply strategic money rules for a recession and avoid being blindsided by irregular expenses.

The beauty of automation? It removes willpower from the equation. No decisions, no temptations, no forgetting – just consistent progress toward financial security.

In recession preparation, consistency trumps intensity every time.

E. Maintain a Strong Credit Score for Future Options

During economic downturns, credit becomes both harder to get and more important to have.

Your credit score is essentially your financial reputation in number form. When lenders get nervous (as they do in recessions), they become pickier about who gets approved.

Keeping your score above 740 opens doors when others find them slammed shut. To maintain or improve your score:

- Never miss payments (set up autopay for at least minimum amounts)

- Keep credit utilization under 30% (under 10% is even better)

- Don’t close old accounts unnecessarily

- Limit hard inquiries by avoiding application sprees

- Monitor your reports regularly for errors (free at AnnualCreditReport.com)

A strong credit score might mean the difference between securing emergency financing during tough times or being turned away. It affects insurance rates, rental applications, and even job opportunities.

Think of it as financial insurance – it costs nothing to maintain but provides valuable protection when you need it most.

Diversify Your Income Streams

A. Develop Skills That Remain Valuable During Economic Downturns

When the economy tanks, certain skills become golden tickets. Think about it – healthcare professionals, IT specialists, and skilled trades workers rarely struggle to find work, even when pink slips are flying everywhere else.

The trick is to identify recession-proof skills and start building them now. Digital marketing, data analysis, cybersecurity, and software development aren’t going anywhere. Neither are plumbing, electrical work, or healthcare services.

Ask yourself: “What problems will people still need solved, even when money’s tight?” Those are your target skills.

Take an hour each week to upskill through online courses, certifications, or hands-on practice. Platforms like Coursera, LinkedIn Learning, and YouTube offer affordable (sometimes free) ways to build marketable skills—an often overlooked but powerful part of strategic money rules for a recession.

B. Create Passive Income Sources to Supplement Your Salary

Your 9-to-5 job shouldn’t be your only income source. Period.

Passive income streams work for you while you sleep. They’re your financial backup singers when the lead vocalist (your main job) hits a rough patch.

Some reliable options include:

- Dividend-paying stocks and ETFs

- Real estate investments or REITs

- Creating and selling digital products

- Building a content-based website with ad revenue

- Peer-to-peer lending

Start small. Even $100 invested monthly in dividend stocks can grow into a meaningful income stream over time.

C. Explore Side Hustles That Can Scale If Needed

Side hustles aren’t just about extra cash now – they’re potential lifeboats during economic storms.

The best recession-ready side hustles share common traits:

- Low startup costs

- Flexible time commitments

- Potential to scale quickly

Some proven options:

- Freelance writing, design, or programming

- Virtual assistance or bookkeeping

- Online teaching or tutoring

- Selling handmade goods or printables

- Dog walking or pet sitting

Pick something aligned with your skills and interests. Then give it a consistent 5-10 hours weekly. Document everything so you can quickly scale up if your main income takes a hit—this kind of side hustle prep fits squarely within strategic money rules for a recession.

D. Build Business Relationships Across Different Industries

Your network becomes your net worth during economic downturns.

Cross-industry connections are particularly valuable – when one sector struggles, your contacts in thriving industries become golden.

Don’t wait for tough times to start building these relationships. Join professional organizations, attend virtual conferences, and connect genuinely on LinkedIn with people outside your immediate field.

The key is reciprocity – offer value before asking for anything. Share industry insights, make introductions, or provide feedback on projects. These goodwill deposits create a relationship bank you can withdraw from when needed.

Optimize Your Investment Strategy

Reassess Your Risk Tolerance Before the Downturn

When was the last time you really thought about your risk tolerance? Not what some financial advisor told you after a 5-minute questionnaire, but how you actually feel watching your investments drop 20% in a week?

Most people discover their true risk tolerance during a market crash—and that’s the worst time to find out. With recession signals flashing, now’s your chance to honestly evaluate what you can stomach.

Ask yourself: “If my portfolio dropped 30% tomorrow, would I sleep at night?” If the answer makes you sweat, it’s time to dial back your risk exposure.

Your risk tolerance isn’t just about emotions—it’s about your time horizon too. If retirement is decades away, you can weather the storm. If you need that money in the next 2-3 years, you simply can’t afford the same exposure.

Balance Your Portfolio with Defensive Assets

When storm clouds gather, you don’t throw away your umbrella. You get a better one.

Defensive assets are your financial umbrella during economic downpours. They won’t make you rich overnight, but they’ll keep you dry when everything else gets soaked—a cornerstone of strategic money rules for a recession.

Here’s what belongs in your recession toolkit:

- Treasury bonds – Still the ultimate safe haven when markets panic

- Consumer staples stocks – People still need toothpaste and toilet paper in recessions

- Utilities – Everyone keeps the lights on, even in tough times

- Cash – Not exciting, but extremely valuable when bargains appear

- Gold – The classic inflation hedge that tends to shine during uncertainty

The trick isn’t going all-in on defensives—it’s finding the right balance. A portfolio with 30-40% in defensive assets can dramatically reduce your downside while still capturing upside.

Avoid Panic Selling During Market Volatility

The biggest wealth destroyer isn’t recessions—it’s how people react to them.

When markets tank, your brain floods with cortisol and adrenaline. These chemicals evolved to help you run from predators, not make smart investment decisions. Your instincts will scream “sell everything!” precisely when you should be staying the course or even buying more.

Historically, investors who panic-sell during downturns lock in permanent losses and miss the recovery. Remember March 2020? The folks who sold at the bottom missed a 100%+ rally over the next year.

Create a pre-commitment strategy now, before emotions take over. Write down exactly what you’ll do during different market scenarios. Something simple like: “If the market drops 20%, I will rebalance but not sell.” Then give this to a trusted friend or advisor who’ll hold you accountable.

Look for Discounted Investment Opportunities

Recessions aren’t just threats—they’re massive opportunities for patient investors.

Great companies often get thrown out with the bathwater during market panics. Their fundamentals remain solid, but fear drives their prices to irrational lows.

Warren Buffett said it best: “Be fearful when others are greedy, and greedy when others are fearful.”

Start building your recession shopping list now:

- Identify 10-15 quality companies you’d love to own

- Determine a “buy price” that would represent exceptional value

- Set aside cash specifically for these opportunities

- Be patient—the best deals don’t last long in panics

Focus on businesses with strong balance sheets, minimal debt, and consistent cash flows. These companies not only survive recessions—they often emerge stronger by acquiring struggling competitors or gaining market share. Prioritizing these investments aligns with strategic money rules for a recession.

Consider Dollar-Cost Averaging to Reduce Timing Risk

Nobody—not even Wall Street pros—can consistently time market bottoms. That’s why dollar-cost averaging is your secret weapon during recessions.

Instead of throwing all your money in at once (or sitting completely in cash), invest fixed amounts at regular intervals regardless of market conditions. When prices drop, you automatically buy more shares. When they rise, you buy fewer.

This approach works brilliantly during recessions because:

- It removes emotion from the equation

- You don’t need to guess the bottom

- You’re guaranteed to catch at least some of the recovery

- It transforms volatility from enemy to ally

During the 2008-2009 crash, investors who dollar-cost averaged through the entire period significantly outperformed those who waited for “certainty” before reinvesting.

The key is consistency. Set up automatic investments and stick to your schedule even when it feels uncomfortable—especially when it feels uncomfortable.

Protect Your Career Prospects

Your job isn’t just something that pays the bills—it’s your financial safety net during tough economic times. When recession clouds gather, protecting your career becomes as crucial as managing your savings.

Become Indispensable at Your Current Workplace

Want to recession-proof your job? Make yourself the person your company can’t afford to lose. This goes beyond just doing your work—it means becoming the go-to problem solver everyone relies on.

Take on high-visibility projects that directly impact the bottom line. Track your wins and quantify your contributions. Did you help increase sales by 15%? Save the company $20,000 through process improvements? These numbers become your armor when layoff discussions happen—an essential tactic within strategic money rules for a recession.

Cross-train across departments to fill multiple roles. The employee who can wear three hats is far more valuable than one who wears just one.

Update Your Skills to Match Recession-Resistant Jobs

The skills that kept you employed yesterday might not protect you tomorrow. Look at which industries historically weather recessions best—healthcare, utilities, cybersecurity, and essential services rarely see the deep cuts other sectors face.

Don’t wait for a pink slip to start skill-building. Set aside 5 hours weekly for courses, certifications, or training that align with recession-resistant fields. Many valuable credentials can be earned online in just 2-3 months.

Popular recession-resistant skills include:

- Data analysis and interpretation

- Digital marketing and e-commerce

- Cybersecurity and IT infrastructure

- Healthcare technology

- Supply chain optimization

Expand Your Professional Network Before You Need It

The worst time to start networking is when you’re desperate for a job. The connections that save careers are built long before economic storms hit.

Aim to add three new quality connections monthly. Attend industry events, participate in relevant online communities, and schedule coffee chats with colleagues from adjacent departments or companies.

Remember: networking isn’t about collecting business cards or LinkedIn connections—it’s about building genuine relationships where you provide value first. The person who helped five people last year will find five people eager to help when layoffs come.

Prepare an Updated Resume and LinkedIn Profile

Your emergency career kit should always be ready. Update your resume quarterly with fresh accomplishments and new skills. Your LinkedIn profile needs similar attention—especially recommendations and endorsements.

When recession hits, hiring freezes often follow. Companies that are still recruiting face floods of applicants. Your materials need to stand out immediately.

Create different versions of your resume tailored to various potential career paths. Have a portfolio of work samples ready. Practice your interview responses for tough questions about gaps, layoffs, or career changes.

Strategically Manage Your Housing Costs

Evaluate Rent vs. Buy Decisions in Your Market

Housing costs typically eat up the biggest chunk of your monthly budget. When a recession looms, making the right housing decision can make or break your financial stability.

The rent-versus-buy equation isn’t one-size-fits-all, especially in uncertain economic times. Look at your local market conditions – not what worked for your cousin in another state.

Right now, many markets have sky-high home prices but relatively stable rent costs. Do the math:

| Ownership Costs | Rental Costs |

|---|---|

| Mortgage payment | Monthly rent |

| Property taxes | Renter’s insurance |

| Homeowner’s insurance | Utilities |

| Maintenance (1-3% of home value annually) | No maintenance costs |

| Less flexibility during economic uncertainty | Ability to downsize quickly |

The old “renting is throwing money away” myth? Pure nonsense. Renting provides flexibility that’s invaluable during recessions. If you need to relocate for work or downsize quickly, renting makes it far easier.

If you’re already a homeowner, now’s the time to stress-test your housing budget. Could you still make payments if your income dropped by 20%? If not, consider downsizing before economic pressure forces your hand.

Consider Refinancing While Rates Are Favorable

Interest rates fluctuate wildly during economic shifts. If you already own a home and haven’t refinanced recently, you might be leaving serious money on the table.

Even a 0.5% reduction in your interest rate can save thousands over the life of your loan. For example, on a $300,000 mortgage:

| Rate | Monthly Payment | 30-Year Interest Paid |

|---|---|---|

| 4.5% | $1,520 | $247,220 |

| 4.0% | $1,432 | $215,609 |

| Savings: | $88/month | $31,611 total |

But don’t just chase a lower rate. Factor in closing costs (typically 2-5% of the loan amount) and how long you plan to stay in the home. The break-even point matters – if you’re moving in two years, refinancing often doesn’t make financial sense.

Also, avoid the temptation to cash out equity unless absolutely necessary. Your home equity might become a crucial safety net during a recession.

Eliminate Private Mortgage Insurance If Possible

PMI is basically money down the drain – it protects the lender, not you. If you’re paying PMI (typically required when you put less than 20% down), getting rid of it should be high on your recession prep list.

Once you hit 20% equity in your home, you can request PMI removal. With property values still high in many areas, you might already be there without realizing it. A simple appraisal could save you $100-300 monthly.

If you’re close to that 20% threshold, consider making extra principal payments to cross the finish line. Every dollar you spend eliminating PMI gives you an immediate, guaranteed return.

Explore House Hacking to Reduce Housing Expenses

House hacking might sound like computer jargon, but it’s actually one of the smartest housing strategies for recession-proofing your finances.

The concept is simple: find ways to generate income from your living space. Options include:

- Renting out a spare bedroom

- Converting part of your home into an income-producing Airbnb

- Adding a basement or garage apartment

- Buying a duplex or multi-unit property and living in one unit

House hacking can dramatically reduce your housing burden. Imagine cutting your housing costs in half – or even living for free – while building equity. That’s financial resilience that can weather any economic storm.

The best part? During recessions, rental demand often increases as fewer people buy homes. Your rental income might actually become more stable when the economy struggles.

Cut Expenses Without Sacrificing Quality of Life

Audit Subscriptions and Recurring Charges

When’s the last time you actually checked what’s draining your bank account each month? Most of us are bleeding money through forgotten subscriptions and auto-renewals we barely use.

Take 30 minutes this weekend to hunt down every recurring charge. Log into your bank accounts and credit cards, then make a simple spreadsheet with three columns: the service, monthly cost, and how often you actually use it. This exercise is a foundational part of strategic money rules for a recession—cutting waste before crisis hits.

You’ll probably find at least $50-100 of pure waste. That streaming service you watched once? Gone. The meditation app you opened twice? Bye. The gym membership collecting dust since January? You know what to do.

Pro tip: Use subscription management apps like Rocket Money or Trim to catch everything. They’ll even cancel services for you (though they take a cut of your savings).

Negotiate Better Rates on Essential Services

Most people just accept whatever price hikes their cable, internet, or insurance companies throw at them. Big mistake.

Call your providers armed with competitors’ offers. A simple “I’m considering switching to [competitor] for their lower rate” can instantly save you 10-30% without losing service quality.

Your script:

- “I’ve been a loyal customer for X years”

- “I noticed [competitor] is offering a better rate”

- “What can you do to keep my business?”

- If they say no, ask for the “retention department”

Cable and internet companies are notorious for folding under pressure – their customer acquisition costs are high, so they’d rather keep you at a discount.

Embrace Strategic Frugality, Not Deprivation

Cutting expenses doesn’t mean living a joyless existence eating ramen by candlelight. It’s about making intentional choices.

Strategic frugality means cutting ruthlessly in areas you don’t care about while preserving what truly brings you joy. Maybe you ditch the designer coffee but keep your weekend hiking trips. Or you downsize your living space but maintain your book budget.

The trick is knowing yourself. What expenses actually improve your life versus what do you spend on out of habit or social pressure?

Some quick wins:

- Cook at home 5 nights instead of 3

- Wait 48 hours before any non-essential purchase over $50

- Share subscription costs with friends/family

- Buy quality essentials that last longer

Practice Mindful Spending on Non-Essentials

Most unnecessary spending happens on autopilot. You’re bored, stressed, or scrolling through Instagram, and suddenly you’ve bought something you didn’t need.

Implement the 24-hour rule for impulse purchases. Add items to your cart, then walk away for a day. Most of the time, the urge passes.

For entertainment expenses, create a “fun fund” with strict monthly limits. When it’s gone, it’s gone – but within those boundaries, enjoy without guilt.

Ask yourself these questions before buying:

- Will this bring me joy a month from now?

- Is this solving a real problem or creating more?

- Could I borrow or rent this instead?

- Am I buying this to impress others?

The goal isn’t to eliminate all pleasure spending but to make sure each dollar serves your actual happiness, not just momentary distraction.

Leverage Tax Strategies to Preserve Wealth

Maximize Retirement Account Contributions

In a recession, your tax strategy becomes your secret weapon. When times get tough, the IRS doesn’t cut you any slack – but smart retirement contributions can.

Max out your 401(k), IRA, or HSA contributions now. In 2025, you can put up to $23,000 in your 401(k) and $7,000 in your IRA ($8,000 if you’re over 50). This isn’t just about retirement—it’s about slashing your taxable income today when you need that cash flow most, making it a savvy move within strategic money rules for a recession.

Think about this: putting $20,000 in your 401(k) could save you $4,400 in taxes if you’re in the 22% bracket. That’s money back in your pocket during uncertain times.

Harvest Tax Losses in Investment Accounts

Market downturns aren’t fun, but they do create tax opportunities. Tax-loss harvesting is like finding cash in the couch cushions of your portfolio.

Here’s how it works: sell investments that have dropped below what you paid, use those losses to offset capital gains, and you can even deduct up to $3,000 against your regular income. Then immediately reinvest in similar (but not identical) assets to maintain your investment strategy.

The best part? Most people miss this opportunity because they’re too scared to lock in losses. But those paper losses can translate to real tax savings right when your budget is getting squeezed.

Understand Tax Implications of Different Income Sources

Not all money coming in gets taxed the same way – and that matters hugely during a recession.

| Income Source | Tax Treatment | Recession Strategy |

|---|---|---|

| W-2 Income | Fully taxable | Increase pre-tax deductions |

| Qualified Dividends | Lower rates than regular income | Hold in taxable accounts |

| Municipal Bond Interest | Often tax-free | Consider for emergency funds |

| Capital Gains | 0-20% based on income | Strategic gain/loss planning |

Smart moves: shift more toward tax-advantaged income sources. Prioritize qualified dividends over interest income. Consider municipal bonds for safety with tax advantages.

Consider Roth Conversions During Market Downturns

Recessions create a perfect storm for Roth conversions. When your traditional IRA or 401(k) takes a hit, you can convert those assets to Roth accounts at a discount.

Why this matters: you’ll pay taxes on the converted amount now, but at a lower value. Then all future growth happens tax-free. Forever.

Example: Your $100,000 IRA drops to $70,000 during a market correction. Converting now means paying taxes on $70,000 instead of $100,000. When markets recover (and they always do), all that growth is completely tax-free.

This strategy works especially well if you expect to be in a higher tax bracket later, or if you believe tax rates will rise to address growing national debt after the recession.

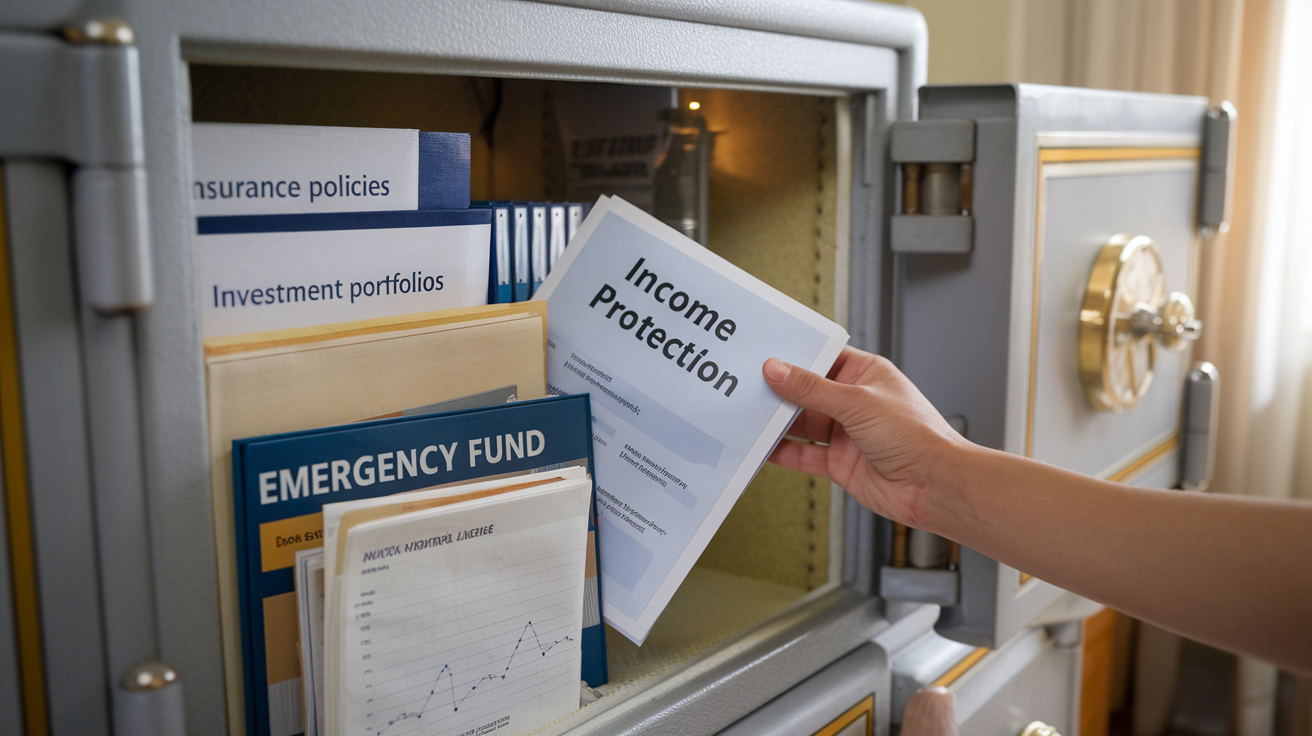

Protect Your Assets and Income

A. Review and Update Insurance Coverage

When a recession hits, your insurance becomes your financial safety net. But here’s the thing – most people set up their insurance once and forget about it. Big mistake.

Take a hard look at your policies right now. That homeowner’s insurance you got five years ago? Probably doesn’t match today’s property values. Your auto coverage might be outdated too.

But don’t just blindly increase coverage. Sometimes you can actually reduce premiums by:

- Bundling multiple policies with one provider

- Increasing deductibles if you have a solid emergency fund

- Removing unnecessary riders that don’t serve you anymore

Health insurance deserves special attention during economic downturns. Medical bankruptcies spike during recessions, so make sure your coverage is rock-solid. Consider whether a high-deductible plan with an HSA might work better for your situation.

B. Create or Update Your Estate Planning Documents

Nobody likes thinking about this stuff. But recessions have a way of reminding us that life is unpredictable.

Your will isn’t just for the ultra-wealthy. It’s for anyone who cares what happens to their stuff, their kids, or their pets.

Without proper estate documents, you’re basically letting the government decide what happens to everything you’ve worked for. And trust me, they don’t know your wishes.

The bare minimum estate package includes:

- A will (specifying guardians if you have children)

- A living trust (to avoid probate)

- Beneficiary designations (for accounts like your 401(k))

C. Establish Healthcare Directives and Powers of Attorney

Economic uncertainty means you need certainty about who makes decisions if you can’t.

Healthcare directives aren’t just for older folks. Young, healthy people get into accidents too. Your directive spells out your medical wishes when you can’t communicate them yourself—an often-overlooked yet vital element of strategic money rules for a recession.

Powers of attorney come in two critical flavors:

- Medical POA – gives someone authority to make health decisions

- Financial POA – allows someone to handle your money matters

Without these, your family might need to go through costly court proceedings just to help you.

D. Consider Disability Insurance to Protect Your Income

Your biggest asset isn’t your house or your investment portfolio. It’s your ability to earn income.

The stats are sobering – you’re more likely to become disabled during your working years than to die. Yet most people insure against death (life insurance) but not disability.

Long-term disability insurance typically covers 60-70% of your income if you can’t work. During a recession, this becomes even more crucial as jobs become scarcer.

Compare these disability insurance options:

| Feature | Short-Term | Long-Term |

|---|---|---|

| Waiting period | 0-14 days | 90-180 days |

| Benefit period | 3-6 months | Until retirement |

| Cost | Lower | Higher |

Your employer might offer some coverage, but it’s rarely enough. Private policies offer better protection and stay with you between jobs.

Prepare Your Family Financially

A. Have Honest Conversations About Money Priorities

Recession talk makes everyone nervous, but avoiding money discussions with your family only makes things worse. The dinner table might feel like an awkward place to bring up finances, but it’s exactly where these conversations need to happen.

Start by discussing what actually matters to your family. Is it maintaining the kids’ activities? Keeping the family vacation tradition alive? Or maybe just ensuring everyone has what they need?

You might be surprised what your spouse or kids consider essential versus optional. My friend Jake was dead-set on maintaining their annual beach trip during the 2008 recession until his 12-year-old daughter mentioned she’d rather cancel it if it meant keeping her weekly art classes. These family conversations are key to practicing strategic money rules for a recession with empathy and alignment.

These conversations work best when:

- Everyone speaks without judgment

- Each person shares their top 3 priorities

- You identify expenses that can be reduced or eliminated

- You create a shared vision of financial stability

Don’t wait for money problems to start these talks. The families who weather recessions best are those who’ve already aligned their financial priorities before crisis hits.

B. Teach Children Age-Appropriate Financial Resilience

Kids absorb financial stress like sponges, even when you think they aren’t paying attention. Rather than sheltering them completely, use economic uncertainty as a teaching moment.

For younger children (ages 5-10):

- Explain the difference between needs and wants

- Involve them in budget-friendly meal planning

- Create simple savings jars for short-term goals

For tweens and teens:

- Discuss how economic cycles work

- Share age-appropriate details about your family’s financial plan

- Encourage entrepreneurial thinking (“How could you earn $20 this month?”)

- Involve them in comparison shopping and finding deals

When my neighbor lost his job in 2020, his 14-year-old started a neighborhood dog walking service that brought in $200 monthly—not because they needed the money desperately, but because she wanted to contribute. That confidence and initiative came from years of financial transparency.

C. Create a Family Emergency Plan for Financial Hardship

A family financial emergency plan isn’t just about numbers—it’s about maintaining stability when everything feels uncertain.

Your plan should cover:

Job loss scenarios – Who will apply for benefits? How quickly can the non-working spouse increase hours or find work?

Housing contingencies – Could you temporarily downsize or move in with family? What mortgage assistance programs exist?

Essential services maintenance – Which utilities could you reduce? What insurance policies are non-negotiable?

Communication protocols – How and when will you update the family on financial status?

The best emergency plans include emotional support strategies too. Financial stress strains relationships, so build in regular check-ins and low-cost family activities that maintain connection during tough times.

One family I know created a “recession ritual”—Friday night board games with homemade pizza—that became so beloved during the last downturn that they’ve maintained it even in better financial times.

D. Pool Resources with Extended Family When Appropriate

Economic downturns often require creative resource sharing. Extended family support systems can make all the difference between struggling and surviving.

Consider these family pooling strategies:

- Multi-family shopping trips to buy in bulk

- Shared childcare arrangements to reduce costs

- Skill exchanges (home repairs, tutoring, tax preparation)

- Joint housing arrangements when necessary

The key is establishing clear boundaries and expectations upfront. Write down agreements about financial contributions, household responsibilities, and—crucially—exit strategies when circumstances improve.

Many families resist these arrangements fearing conflict, but recessions have historically strengthened family bonds when approached thoughtfully. My cousin’s family moved in with her parents during 2010, expecting a tense six months. They ended up staying two years, saving enough for a home down payment while her parents benefited from help with property maintenance and daily companionship—a creative but effective application of strategic money rules for a recession.

Position Yourself for Post-Recession Growth

Keep Cash Available for Opportunistic Investments

Recessions create fire sales. Smart investors know this and position themselves to take advantage when assets go on discount.

Think about it – during the 2008 financial crisis, those with cash reserves picked up properties at 50% off in some markets. By 2019, many of these investments had doubled or tripled in value.

The same principle applies to stocks. When markets tumble 30-40%, quality companies suddenly become bargains. But you can only capitalize if you’ve got dry powder ready.

I recommend keeping 10-15% of your portfolio in cash equivalents during good times. This might seem like you’re missing gains, but that cash becomes incredibly powerful when everything goes on sale.

Here’s what to consider:

- High-yield savings accounts for short-term cash

- Money market funds for slightly better returns

- Treasury bills for safety with modest yield

Remember Warren Buffett’s advice: “Be fearful when others are greedy, and greedy when others are fearful.” That’s only possible with cash in hand.

Plan Major Purchases Around Economic Cycles

Timing is everything with big-ticket items. Cars, homes, luxury goods – they all follow predictable pricing patterns during economic cycles.

During recessions, desperate sellers slash prices. I’ve seen friends save $10,000+ on new vehicles by shopping during downturns when dealerships are struggling to move inventory.

The housing market works similarly. When mortgage applications drop, motivated sellers become more flexible. You might score that dream home at 15-20% below peak market prices.

But this strategy requires patience and preparation:

- Research historical pricing trends in your target market

- Get pre-approved for financing before shopping

- Build a relationship with sellers/agents who understand you’re a serious buyer

- Be ready to move quickly when the right opportunity appears

Don’t feel rushed by FOMO during boom times. The cycle always turns, and patience pays dividends—a timeless principle embedded in strategic money rules for a recession.

Build Skills That Will Be in Demand During Recovery

Every recession reshapes the job market. Some careers vanish while others explode with opportunity.

After the 2020 pandemic recession, remote work skills, digital marketing, and healthcare specialties saw massive demand increases. Those who pivoted early landed better positions with higher pay.

The key is looking beyond current conditions to anticipate what’s coming next. What problems will need solving when growth returns?

Some evergreen skills that historically thrive post-recession:

- Data analysis and interpretation

- Sales and relationship building

- Problem-solving and critical thinking

- Digital transformation expertise

- Crisis management

Don’t wait for the downturn to start building these capabilities. Take online courses now, volunteer for projects that stretch your abilities, or consider certifications that signal your expertise.

Your competition will be focused on survival. You’ll be focused on thriving when the economy rebounds.

Maintain a Growth Mindset Despite Economic Challenges

Recessions mess with your head. They create fear, anxiety and worst of all – paralysis.

The psychological impact often causes more lasting damage than the financial hit. People who mentally check out during downturns miss the seeds of opportunity being planted all around them.

History shows us that some of today’s most successful companies were born during recessions:

These founders weren’t smarter than everyone else – they just refused to let economic conditions dictate their vision.

Practical ways to maintain your growth mindset:

- Limit consumption of panic-inducing financial news

- Surround yourself with optimistic, forward-thinking people

- Keep a journal of opportunities you observe during the downturn

- Set learning goals rather than just financial ones

- Celebrate small wins to maintain momentum

Your attitude during tough times shapes your trajectory when conditions improve. While others see only problems, train yourself to spot possibilities.

Final Thoughts

Financial preparedness is not just about weathering economic storms—it’s about establishing sustainable habits that serve you in any economic climate. By following these ten strategic money rules, you can build resilience against recession impacts while simultaneously strengthening your overall financial health. From establishing a robust emergency fund and diversifying income streams to optimizing investments and protecting your career prospects, these proactive measures create layers of protection against economic uncertainty.

Don’t wait for economic warning signs to appear before taking action. Start implementing these strategies today to secure your financial future and position yourself for growth when the economy rebounds. Remember that recessions, while challenging, also present unique opportunities for those who are prepared. By adhering to strategic money rules for a recession, you’ll not only survive potential economic downturns but potentially emerge stronger and more financially secure than before.

Explore more smart money moves over on the Investillect blog.