Are you tired of letting fear hold you back from achieving your trading goals? 😰 You’re not alone. Fear is a common challenge that many traders face, often leading to missed opportunities and costly mistakes. But what if you could overcome fear in trading and transform it into confidence and success?

Imagine stepping into the trading world with unwavering confidence, making decisions based on strategy rather than emotion. Picture yourself calmly navigating market fluctuations, secure in your ability to manage risks effectively. This isn’t just a dream – it’s a reality that’s within your reach. 🎯

In this comprehensive guide, we’ll walk you through a step-by-step process to overcome your trading fears. From understanding the root causes of your anxiety to developing a robust trading plan and cultivating a positive mindset, we’ll cover everything you need to know. Get ready to discover powerful techniques, leverage cutting-edge tools, and learn how to continuously improve your trading skills. Let’s embark on this transformative journey together and unlock your true trading potential! For additional insights on managing emotions in the market, check out this CME Group course on trading psychology.

Understanding Trading Fear

A. Identifying common trading fears

Trading fears can significantly impact a trader’s performance and decision-making process. Some of the most common trading fears include:

- Fear of loss

- Fear of missing out (FOMO)

- Fear of being wrong

- Fear of success

- Fear of uncertainty

These fears often manifest in different ways, affecting traders’ ability to execute trades effectively. For example, the fear of loss might lead to premature exits from profitable trades, while FOMO can result in impulsive entries without proper analysis.

B. The psychological impact of fear on decision-making

Fear can have a profound effect on a trader’s decision-making process, often leading to:

| Impact | Description |

|---|---|

| Hesitation | Delayed entry or exit, missing optimal trading opportunities |

| Overtrading | Excessive trading to recover losses or chase profits |

| Analysis paralysis | Overthinking and inability to take action |

| Emotional trading | Making decisions based on emotions rather than logic |

These psychological impacts can create a vicious cycle, where poor decisions lead to increased fear, further affecting future trading decisions.

C. Recognizing fear-driven behaviors in trading

To overcome trading fears, it’s crucial to recognize fear-driven behaviors:

- Frequent position checking

- Inability to stick to a trading plan

- Seeking constant reassurance from others

- Avoiding trades after a loss

- Holding onto losing positions too long

Identifying these behaviors is the first step to developing strategies that help overcome fear in trading. By understanding the root causes and how they affect performance, traders can build a more confident, disciplined approach to the markets.

Now that we’ve explored the psychological aspects of trading fears, let’s move on to developing a robust trading plan that can help mitigate these fears and improve overall trading performance.

Developing a Robust Trading Plan

Setting clear goals and risk tolerance

When developing a robust trading plan, setting clear goals and defining your risk tolerance are crucial first steps. Your goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Here’s a table to help you understand the difference between vague and SMART goals:

| Vague Goal | SMART Goal |

|---|---|

| Make money trading | Achieve a 10% return on investment within 6 months |

| Become a better trader | Complete 3 trading courses and practice in a demo account for 3 months |

Risk tolerance is equally important. It determines how much you’re willing to lose on a single trade or over a specific period. Consider factors like your financial situation, trading experience, and emotional capacity when setting your risk tolerance.

Creating a well-defined entry and exit strategy

A clear entry and exit strategy is essential for consistent trading success. Your entry criteria might include:

- Technical indicators (e.g., moving averages, RSI)

- Price action patterns

- Fundamental analysis factors

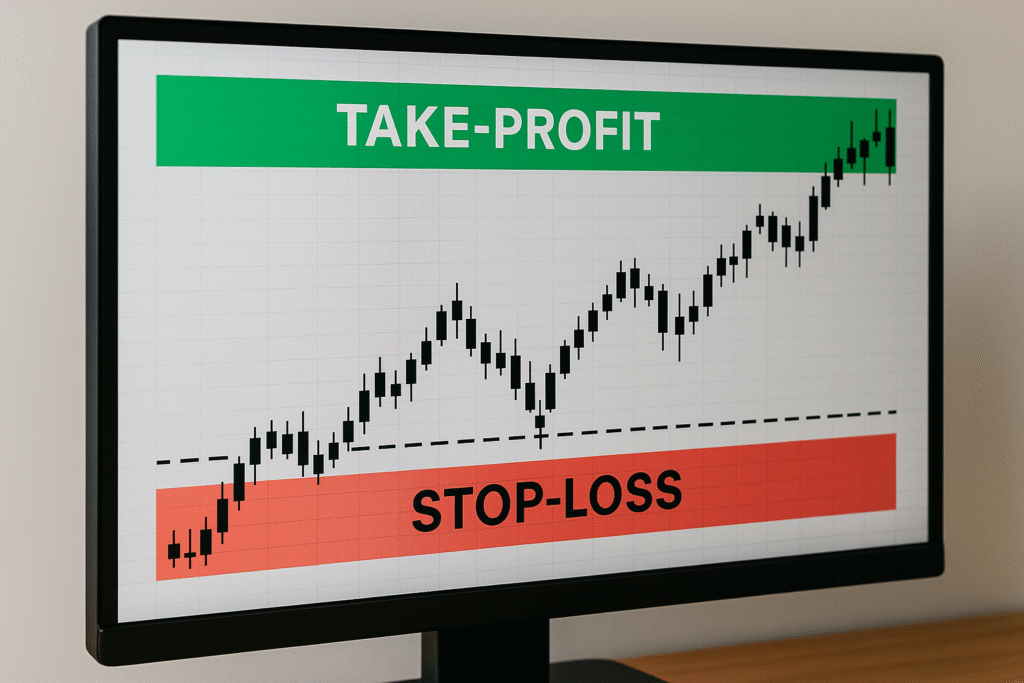

Exit strategies should cover both profit-taking and loss-cutting scenarios. Consider using:

- Fixed take-profit and stop-loss levels

- Trailing stops

- Multiple exit points based on market conditions

Implementing proper position sizing

Position sizing is crucial for managing risk and preserving capital. Here are some common methods:

- Fixed percentage of account balance

- Risk per trade (e.g., 1% of account per trade)

- Volatility-based sizing (using ATR)

Remember, proper position sizing helps protect your account from significant drawdowns and allows for consistent growth over time.

Establishing rules for trade management

Clear rules for managing open trades help remove emotion from decision-making. Consider including:

- Rules for adding to winning positions

- Criteria for closing partial positions

- Guidelines for adjusting stop-loss levels

With these elements in place, your trading plan will provide a solid foundation for overcoming fear and building confidence in your trading decisions.

Building Trading Confidence

Educating yourself on market dynamics

To build trading confidence, start by immersing yourself in market dynamics. Understanding how markets function is crucial for making informed decisions. Here’s a breakdown of key areas to focus on:

| Area of Study | Importance | Resources |

|---|---|---|

| Technical Analysis | Helps predict price movements | Books, online courses, charting software |

| Fundamental Analysis | Evaluates underlying factors | Financial reports, economic indicators |

| Market Sentiment | Gauges overall market mood | News outlets, social media trends |

| Economic Indicators | Provides broader context | Government reports, financial websites |

Practicing with demo accounts

Demo accounts are invaluable tools for honing your skills without risking real money. Follow these steps to maximize your demo trading experience:

- Choose a reputable platform

- Set realistic account balances

- Treat demo trading as real trading

- Test different strategies

- Keep detailed trading journals

Starting small and scaling gradually

When transitioning to live trading, start with small positions to manage risk effectively:

- Begin with micro-lots or fractional shares

- Increase position sizes incrementally as you gain confidence

- Set strict loss limits for each trade

- Diversify across different assets to spread risk

Celebrating small wins and learning from losses

Developing a positive mindset is crucial for building trading confidence. Acknowledge your successes, no matter how small, and view losses as learning opportunities. Create a system to:

- Document each successful trade and analyze why it worked

- Review losing trades objectively to identify areas for improvement

- Set realistic milestones and reward yourself when achieving them

- Join trading communities to share experiences and gain support

By following these steps, you’ll gradually build the confidence needed to navigate the markets effectively. Remember, consistency and continuous learning are key to long-term trading success.

Managing Risk Effectively

Using stop-loss orders

Stop-loss orders are crucial tools for managing risk in trading. They automatically close your position when the price reaches a predetermined level, limiting potential losses. Here’s how to effectively use stop-loss orders:

- Set realistic stop-loss levels

- Adjust stop-losses based on market volatility

- Use trailing stop-losses for trend-following strategies

| Type of Stop-Loss | Description | Best Used For |

|---|---|---|

| Fixed Stop-Loss | Set at a specific price | Range-bound markets |

| Trailing Stop-Loss | Moves with price in favorable direction | Trending markets |

| Time-Based Stop-Loss | Closes position after set time | Intraday trading |

Diversifying your portfolio

Diversification is key to reducing overall risk. By spreading investments across different assets, sectors, or geographic regions, you can mitigate the impact of poor performance in any single area.

Avoiding overexposure to a single trade

Limiting your exposure to any single trade is essential for effective risk management. A common rule of thumb is to never risk more than 1-2% of your trading capital on a single trade. This approach helps protect your account from significant drawdowns.

Implementing risk-reward ratios

Risk-reward ratios help ensure that potential profits justify the risks taken. A commonly used ratio is 1:3, meaning the potential reward should be at least three times the risk. Here’s how to implement risk-reward ratios:

- Identify potential entry and exit points

- Calculate the distance between entry and stop-loss (risk)

- Set take-profit level at least 3 times the risk

By implementing these risk management strategies, traders can protect their capital and maintain a more stable emotional state, crucial for overcoming fear in trading.

Cultivating a Positive Trading Mindset

Practicing mindfulness and meditation

In the fast-paced world of trading, cultivating a positive mindset is crucial for success. One effective way to achieve this is through mindfulness and meditation. These practices can help traders stay focused, reduce stress, and make clearer decisions.

Here are some key benefits of mindfulness and meditation for traders:

- Improved focus and concentration

- Reduced anxiety and stress

- Enhanced emotional regulation

- Better decision-making abilities

- Increased self-awareness

To incorporate mindfulness into your trading routine, try this simple 5-minute meditation exercise:

- Sit comfortably and close your eyes

- Focus on your breath, inhaling and exhaling slowly

- Notice any thoughts without judgment, then return to your breath

- Gradually expand your awareness to your body and surroundings

- Open your eyes and carry this mindful state into your trading

Developing emotional resilience

Emotional resilience is a critical trait for successful traders. It allows you to bounce back from setbacks and maintain a positive outlook despite market fluctuations.

| Strategy | Description | Benefit |

|---|---|---|

| Journaling | Record your trading experiences and emotions | Identifies patterns and triggers |

| Positive self-talk | Replace negative thoughts with constructive ones | Boosts confidence and motivation |

| Regular exercise | Engage in physical activity | Reduces stress and improves mood |

| Stress management techniques | Practice deep breathing or progressive muscle relaxation | Enhances ability to stay calm under pressure |

Reframing losses as learning opportunities

Instead of viewing losses as failures, successful traders see them as valuable learning experiences. This shift in perspective can significantly impact your trading psychology and overall performance.

To reframe losses effectively:

- Analyze each trade objectively

- Identify areas for improvement

- Adjust your strategy based on insights gained

- Focus on long-term growth rather than short-term results

Surrounding yourself with supportive traders

Building a network of supportive traders can provide encouragement, share valuable insights, and help maintain a positive mindset. Consider joining trading communities, attending workshops, or finding a mentor to enhance your trading journey.

Now that we’ve explored ways to cultivate a positive trading mindset, let’s examine how technology and tools can further support your trading success.

Utilizing Technology and Tools

Leveraging trading journals for self-reflection

Trading journals are invaluable tools to overcome fear in trading. By meticulously recording your trades, emotions, and decision-making processes, you create a powerful resource for self-reflection and improvement. This practice helps reduce trading anxiety by turning emotional reactions into structured insights. Here’s how to effectively use a trading journal:

Record key trade details:

- Entry and exit points

- Position size

- Profit/loss

- Market conditions

- Emotions before, during, and after the trade

Analyze patterns:

- Identify successful strategies

- Recognize emotional triggers

- Spot recurring mistakes

| Journal Component | Purpose | Benefit |

|---|---|---|

| Trade Details | Track performance | Objective evaluation |

| Emotional Log | Monitor psychological state | Improve emotional control |

| Market Analysis | Document market conditions | Enhance pattern recognition |

Using automated trading systems to reduce emotional interference

Automated trading systems can significantly reduce the impact of fear on your trading decisions. These systems execute trades based on pre-defined rules, eliminating emotional biases. Benefits include:

- Consistent execution of trading strategies

- Reduced impact of fear and greed on decision-making

- Ability to backtest strategies before live implementation

Employing analytics tools for objective decision-making

Analytics tools provide data-driven insights that can help overcome fear-based decision-making. By relying on objective data rather than emotions, traders can make more informed choices. Key analytics tools include:

- Technical analysis software

- Market sentiment indicators

- Risk management calculators

- Performance tracking dashboards

These tools offer a data-backed approach to trading, helping you build confidence in your decisions and reduce the influence of fear. For a step-by-step breakdown of setting up your own, visit this guide to creating a trading journal. As we move forward, we’ll explore how continuous improvement and adaptation can further enhance your trading skills and mindset.

Continuous Improvement and Adaptation

Regularly reviewing and adjusting your trading strategy

To stay ahead in the ever-changing world of trading, it’s crucial to regularly review and adjust your trading strategy. Here’s a simple process to help you:

- Set a review schedule (e.g., weekly, monthly, quarterly)

- Analyze your trading performance

- Identify strengths and weaknesses

- Make data-driven adjustments

- Test and implement changes

| Review Aspect | Questions to Ask |

|---|---|

| Win Rate | Is it consistent with your expectations? |

| Risk-Reward Ratio | Are you maintaining a favorable ratio? |

| Drawdowns | Are they within acceptable limits? |

| Emotional Control | Are you sticking to your plan? |

Staying updated with market news and trends

Keeping abreast of market news and trends is essential for adapting your trading approach. Consider these methods:

- Subscribe to reputable financial news sources

- Follow industry experts on social media

- Attend webinars and trading conferences

- Use economic calendars to track important events

Seeking mentorship or joining trading communities

Connecting with experienced traders can accelerate your learning curve. Look for:

- Online trading forums and discussion groups

- Local trading meetups

- Professional mentorship programs

- Trading masterclasses or workshops

Embracing a growth mindset in your trading journey

Adopting a growth mindset is key to continuous improvement in trading. This involves:

- Viewing challenges as opportunities to learn

- Embracing failures as valuable lessons

- Focusing on the process rather than just outcomes

- Celebrating small wins and progress

Remember, successful traders are lifelong learners. By consistently applying these principles, you’ll be better equipped to adapt to market changes and improve your trading performance over time.

Conclusion

Overcoming fear in trading is a journey that requires dedication, self-awareness, and a systematic approach. By understanding the root causes of trading fear, developing a robust trading plan, and building confidence through education and practice, traders can significantly reduce anxiety and make more rational decisions. Effective risk management, a positive mindset, and the strategic use of technology further contribute to conquering trading fears.

Remember, mastering your emotions in trading is an ongoing process. Continuously improve your skills, adapt to market changes, and stay committed to your trading goals. With persistence and the right approach, you can transform fear into a powerful tool for growth and success in your trading career. Take the first step today and start implementing these strategies to become a more confident and successful trader. Sharpen your financial edge—check out what’s new on Investillect.