So, you’re finally flirting with the idea of dividend investing for beginners — smart move. I remember when I first cracked open a book on building wealth with dividends — coffee in one hand, highlighter in the other — expecting a dry finance lecture. What I got instead was a revelation: earning passive income while binge-watching Netflix? Count me in.

Whether you’ve heard about beginner dividend investing from your finance-savvy friend or stumbled upon how to invest in dividend stocks during a late-night scroll, this guide is your no-fluff blueprint to financial glow-up.

Forget crypto hype and day-trading stress — this is the long game, the slow-burn strategy that actually works. And the best part? You don’t need to be a Wall Street bro or know what a P/E ratio is (yet).

So, if you’re ready to ditch paycheck-to-paycheck living and start investing in dividend-paying stocks like a boss, let’s dive in. Your future self — chilling with a cocktail while your money works overtime — will thank you.

Understanding Dividend Stocks

What are dividend stocks and how they create wealth

Imagine this: you invest in a company, and it rewards you regularly just for holding its stock. That’s the essence of dividend investing for beginners. Dividend stocks are shares in companies that return a portion of their profits to shareholders, typically in the form of cash payments or additional shares.

I still recall the thrill of receiving my first dividend payment—a modest sum, but it felt like a milestone. It was a tangible reward for my investment, and it sparked a realization: this is a pathway to building wealth.

By consistently reinvesting these dividends, you tap into the power of compound growth. Over time, this strategy can significantly enhance your financial standing, offering a steady stream of passive income.

For a comprehensive guide on initiating your journey into dividend investing, consider exploring this resource: How to Build Your Dividend Growth Portfolio From Scratch.

Pro tip: Start with companies known for consistent dividend payouts. Over time, reinvesting these dividends can lead to substantial wealth accumulation.

Ready to embark on this journey? Let’s delve deeper.

The power of dividend compounding

Let me tell you a secret the ultra-rich already know: dividend compounding is where wealth goes to quietly explode. It’s not about flashy trades or timing the market — it’s about consistency. You take the cash your dividend stocks pay you, reinvest it into more shares, and those shares pay you more dividends. Repeat. That’s it.

It’s the snowball effect in finance. And the longer it rolls, the bigger it grows. I once ran a mock portfolio with just $100/month in dividend reinvestment — after a decade, it was worth more than double what I put in, just from reinvesting earnings. That’s how to invest in dividend stocks the smart way.

Even Einstein allegedly called compound interest the “eighth wonder of the world.” And while that quote may be overused, the math isn’t wrong.

For a data-rich, real-world look at how reinvesting dividends shapes portfolio growth, check out this chart-filled explainer from Dividend Growth Investor.

Bottom line: Dividend compounding turns steady payers into wealth creators. Start early, stay consistent, and let the math flex for you.

Curious how to set up a dividend reinvestment plan (DRIP) that runs on autopilot? Let’s get into it next.

Differences between dividend stocks and growth stocks

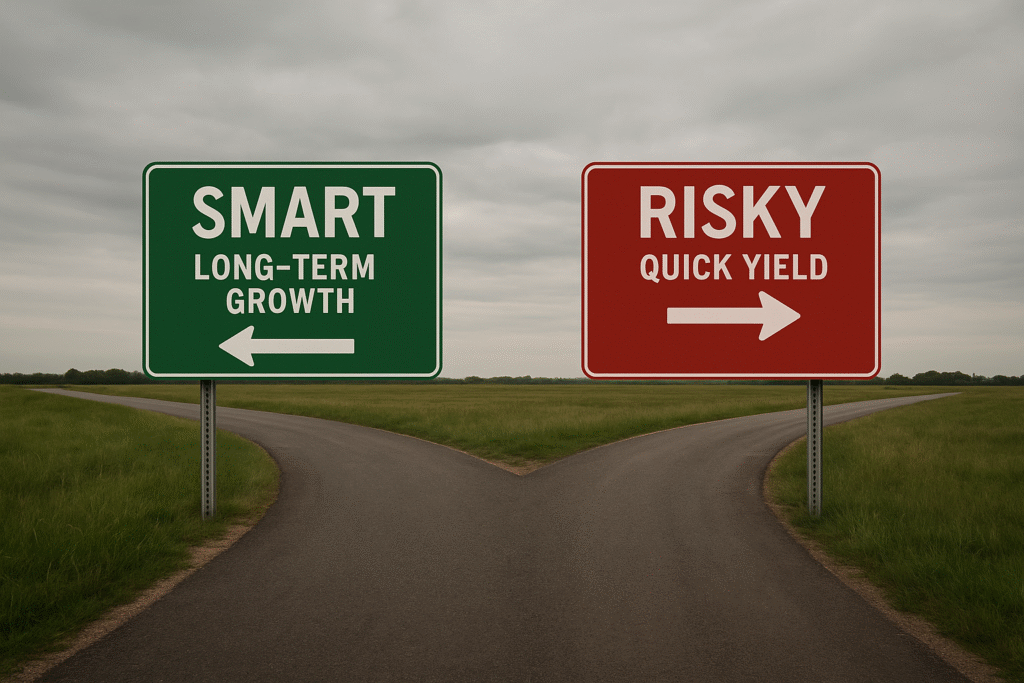

Here’s where the investing personality quiz kicks in: are you into slow, steady cash flow or high-octane potential? Understanding the difference between dividend stocks and growth stocks is key to building a strategy that fits your vibe — and your goals.

Dividend stocks are like that reliable friend who always pays you back — with interest. They hand you regular payouts (aka dividends), making them ideal for those looking to build wealth with dividends and score some passive income along the way.

Growth stocks? They’re the ambitious upstarts. Instead of paying you now, they reinvest every dollar to fuel expansion, aiming to skyrocket in value. Think early-stage tech or disruptive healthcare. No checks in the mail, but the long-term payoff could be massive — if the company makes it.

Back when I started investing, I split my portfolio like a playlist: chill dividend stocks for the steady groove, and growth stocks for the occasional banger. It kept my risk balanced and my curiosity fed.

For a sharp visual breakdown that really drives the difference home, check out this quick explainer video by Jeff Teeples — it’s the kind of clarity every new investor needs.

Pro tip: You don’t have to pick a side. A smart mix of both can give you current income and future upside. So, what’s your flavor — slow money or moonshots? Or both?

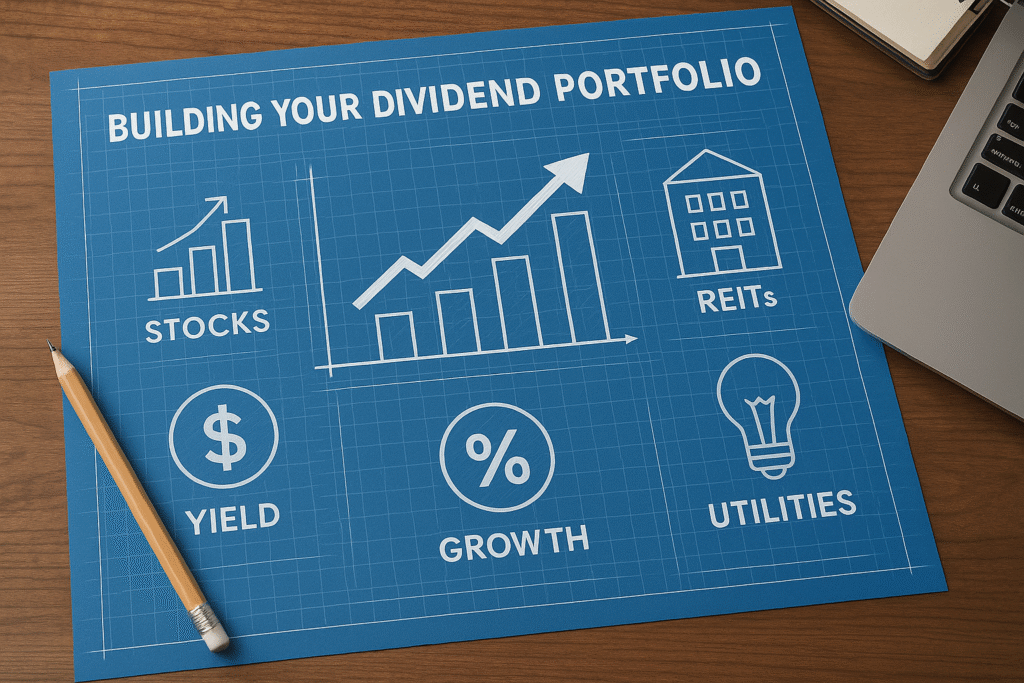

Types of dividend-paying companies

Not all dividend-paying companies are created equal — and knowing which flavor you’re dealing with can make or break your strategy. Whether you’re playing it safe or swinging for yield, here’s the breakdown of the usual suspects in the dividend investing for beginners arena.

- Blue-Chip Giants

- Household names with steady payouts — think Coca-Cola or Microsoft.

- Dividend Aristocrats

- 25+ years of dividend hikes. The gold standard for steady income.

- REITs

- Real estate cash flow, minus the property headaches. High yield, solid returns.

- Utilities

- Slow growth, stable payouts. Power companies make powerful dividend players.

- High-Yield Stocks

- Tempting payouts, but high risk. Do your homework before diving in.

Check out this full list of Dividend Aristocrats for investing inspo.

Benefits of Dividend Investing

Creating passive income streams

Passive income isn’t just a buzzword — it’s the dream. Money while you sleep? Yes, please.

Dividend stocks are one of the most accessible ways to start. With each payout, you’re building a stream that requires no clocking in. Think of it as financial self-care.

I still remember when my first few dividend checks could barely cover a Spotify subscription — now, they help fund my travel budget.

Other streams to explore:

• REITs for real estate returns

• Peer-to-peer lending (high risk, high intrigue)

• Digital products or affiliate marketing if you’re web-savvy

For a deeper dive into building passive income, check out the Smart Passive Income Podcast by Pat Flynn. It’s packed with actionable strategies and real-life success stories.

Pro tip: Stack your streams, automate where possible, and let your money hustle for you.

Lower volatility compared to non-dividend stocks

Here’s the chill part of dividend investing for beginners: it’s often less of a rollercoaster.

Dividend-paying companies are typically mature, stable, and not chasing flashy valuations. That means fewer price swings and more peace of mind — especially when markets get jumpy.

During my first market dip, my dividend portfolio barely flinched, while my tech-heavy picks… let’s just say they were doing acrobatics.

And while nothing’s risk-free, dividends provide a cushion — they pay you to wait.

Want proof? Morningstar’s research shows dividend stocks often hold up better in down markets.

Pro tip: Use dividends as your financial seatbelt — smoother ride, steady rewards.

Hedge against inflation

Inflation’s like that sneaky subscription fee — always creeping up. But here’s the good news: dividend investing can help fight back.

Quality dividend stocks — especially those that consistently raise payouts — often grow faster than inflation. That means your income doesn’t just survive rising costs… it outpaces them.

When groceries and gas prices started climbing last year, my dividend income didn’t just keep up — it covered the gap.

Look into companies with a track record of increasing dividends annually. They’re like financial armor against shrinking dollar value.

For a deeper exploration of how dividend investing can help protect your portfolio from inflation, consider listening to this episode of the Simply Investing Dividend Podcast: Learn How to Beat Inflation with Dividend Stocks.

Pro tip: Don’t just save — invest in assets that grow with the economy. Let dividends be your built-in inflation defense.

Tax advantages of qualified dividends

Let’s talk about one of the more underrated perks of dividend investing: taxes — or rather, paying less of them.

Qualified dividends (from U.S. companies or approved foreign ones, held long enough) are taxed at the long-term capital gains rate — which is way lower than regular income tax for most people. That’s money staying in your pocket.

When I first learned this, I literally restructured part of my portfolio — why pay 22% when I could pay 15% or even zero?

But there’s a catch: not all dividends are “qualified.” REITs, for example, usually aren’t. So knowing what’s in your portfolio matters.

Need the specifics broken down? This guide from the IRS lays it out — jargon and all.

Pro tip: Structure your investments to favor qualified dividends. It’s legal tax efficiency, and your future self

Building wealth through dollar-cost averaging

Here’s how smart investors play the long game — without trying to time the market: dollar-cost averaging (DCA). It’s the quiet MVP move behind many successful dividend investing for beginners strategies.

You invest a fixed amount on a regular schedule, rain or shine. So when prices dip, you buy more shares; when prices rise, you buy fewer. Over time, this levels out your average cost and reduces emotional investing.

I started DCA’ing into dividend stocks with just $100 a month. Didn’t feel like much — until I looked back two years later and saw my portfolio growing on autopilot.

It’s consistent. It’s low-stress. And paired with dividend reinvestment? It’s wealth compounding in slow motion.

For a quick visual breakdown of how dollar-cost averaging works in real time, check out this explainer video by Danny Sully — it’s clean, smart, and seriously useful.

Pro tip: Automate your DCA contributions and let compound growth + dividends do the heavy lifting.

Key Metrics for Evaluating Dividend Stocks

Dividend Yield vs. Dividend Growth Rate

Here’s the deal: dividend yield shows you how much cash a stock is paying right now. Dividend growth rate tells you how much that payout has increased over time.

One’s your current paycheck. The other? Your raise potential.

When I first started dividend investing for beginners, I chased high yields — and got burned. A sky-high yield often signals risk. Now I look for solid companies growing their payouts steadily.

Think of it like this: a 2% yield growing 8% a year can outpace a stagnant 5% over time. It’s not about now — it’s about momentum.

For a sharp, research-backed breakdown of this exact debate, check out this article from OSAM — it’s packed with data and insight minus the fluff.

Pro tip: Balance both. A solid starting yield with consistent growth is a dividend sweet spot.

Payout Ratio: Finding Sustainable Dividends

Want to know if a dividend is sustainable? The payout ratio is your best friend.

This crucial metric tells you what percentage of earnings a company dishes out as dividends. Calculate it by dividing the annual dividend by earnings per share (EPS).

Payout Ratio = Annual Dividend per Share ÷ Earnings per Share

The payout ratio acts as your early warning system. When companies start paying out too much of their earnings, they’re walking a dangerous tightrope.

Different industries have different “healthy” payout ratios:

| Industry | Typical Healthy Payout Range |

|---|---|

| Utilities | 60-80% |

| REITs | 70-90% |

| Consumer Staples | 50-75% |

| Technology | 20-50% |

| Growth Companies | <30% |

A tech company paying 80% of earnings as dividends is a red flag—they’re sacrificing funds that should go toward innovation and staying competitive. Meanwhile, a utility with a 75% payout is perfectly normal given their stable business model.

Watch out for payout ratios above 100%—this means the company is paying more in dividends than it earns! Unless it’s a temporary situation with clear explanation, this typically spells trouble ahead.

Some companies maintain high payouts by borrowing money or selling assets. This isn’t sustainable long-term and often precedes a painful dividend cut.

The sweet spot? Companies paying 30-60% of earnings as dividends generally have the best balance—rewarding shareholders while maintaining financial flexibility to weather downturns and invest in future growth.

Dig deeper by examining the payout ratio trend over several years. A gradually increasing ratio might indicate slowing growth, while a declining ratio could mean the company is becoming more conservative or planning major investments.

Dividend History and Consistency

Nothing speaks louder about a company’s dividend commitment than its track record.

Dividend Aristocrats—S&P 500 companies that have increased dividends for at least 25 consecutive years—aren’t just impressive statistics. They represent businesses that prioritized shareholder returns through recessions, market crashes, technological disruptions, and changing consumer preferences.

Companies like Procter & Gamble (increasing dividends for 66+ years) or Coca-Cola (59+ years) demonstrate remarkable resilience. When a company has raised dividends through multiple economic cycles, it says volumes about management’s confidence and the business model’s durability.

This consistency isn’t just about bragging rights. Stocks with lengthy dividend growth histories typically:

- Have established competitive advantages (“moats”)

- Generate reliable cash flows

- Maintain conservative balance sheets

- Exercise disciplined capital allocation

Pay attention to how companies behaved during previous recessions. Did they maintain dividends during 2008-2009? How about during the COVID-19 pandemic? Companies that protected their dividends during these stress tests demonstrated real commitment to shareholders.

Some warning signs to watch for in dividend history:

- Frequent dividend freezes

- Erratic increases (big jumps followed by tiny ones)

- History of cuts during minor industry downturns

- Recent dramatic increases that seem unsustainable

The length of the streak matters, but how companies behave during tough times reveals their true character. A business that slashed dividends at the first sign of trouble likely will again.

Don’t just count the years—look at the growth rate consistency too. Companies with steady, predictable dividend increases (like 7-9% annually) often make better investments than those swinging between 1% and 20% increases with no pattern.

Remember: past performance doesn’t guarantee future results, but dividend history provides powerful clues about management’s priorities and the durability of the business model.

Free Cash Flow Analysis

Earnings can be manipulated, but cash flow rarely lies. That’s why analyzing free cash flow is absolutely critical when evaluating dividend stocks.

Free cash flow (FCF) represents the actual cash a company generates after covering operating expenses and capital expenditures. Unlike accounting earnings, FCF shows what’s truly available to pay dividends, buy back shares, pay down debt, or reinvest in the business.

Calculate FCF by subtracting capital expenditures from operating cash flow:

Free Cash Flow = Operating Cash Flow - Capital Expenditures

The dividend coverage ratio using FCF gives you a more accurate picture of sustainability:

FCF Dividend Coverage Ratio = Free Cash Flow ÷ Total Dividends Paid

Ideally, you want this ratio comfortably above 1.0—meaning the company generates more free cash than it pays in dividends. A ratio of 1.5 or higher provides a healthy margin of safety.

When companies consistently pay dividends without adequate free cash flow, they’re essentially funding those payments through:

- Debt (borrowing money)

- Asset sales (shrinking the business)

- Equity issuance (diluting existing shareholders)

None of these approaches works long-term.

Free cash flow tends to fluctuate more than earnings, so examine several years of data. Look for consistent FCF that exceeds dividend payments, with an upward trend over time.

Some industries naturally have lumpy capital expenditures. Energy companies might have years of heavy investment followed by periods of lower spending. In these cases, average the FCF over 3-5 years for a clearer picture.

Watch for companies with deteriorating FCF trends but increasing dividends—this divergence rarely ends well for income investors.

FCF analysis also reveals whether a company can simultaneously:

- Pay its dividend

- Reduce debt

- Fund needed investments for future growth

Companies that struggle to do all three often face dividend cuts when industry conditions worsen.

The most sustainable dividend stocks generate growing free cash flow from operations rather than one-time events or accounting manipulations. This provides the foundation for decades of increasing payments to shareholders.

Building Your Dividend Portfolio

Setting clear investment goals

Before you chase dividends, get clear on why you’re investing. Are you stacking cash for retirement? A down payment? Or just trying to escape the 9–5?

When I first got into dividend investing, I thought “more money” was enough of a goal. Spoiler: it wasn’t. Once I set a target — $500/month in passive income — my strategy sharpened instantly.

Clear goals guide your stock picks, risk tolerance, and how much you reinvest.

For a smart, no-nonsense guide to shaping your financial plan, check out this Investopedia article — it’s goal-setting gold for investors at any level.

Pro tip: Write it down. Revisit it often. Invest with purpose, not just hope.

Determining your risk tolerance

Let’s talk about sleep. Specifically, how well you sleep when markets tank 20%.

Your risk tolerance isn’t just some investing buzzword – it’s a real psychological limit that determines your success with dividend stocks.

Here’s a hard truth: Many investors overestimate their risk tolerance until they experience their first major market correction. Suddenly, those “long-term” plans get tossed out the window in a panic.

Ask yourself these questions:

- How did you react (or would you react) to the March 2020 crash?

- If your portfolio dropped 30%, would you sell, hold, or buy more?

- What percentage of your net worth are you comfortable investing in stocks?

Your answers reveal your true risk tolerance, which should directly influence your dividend portfolio construction.

Lower risk tolerance? Lean toward established dividend aristocrats like Johnson & Johnson or Procter & Gamble – companies that have increased dividends for 25+ consecutive years. Yes, they might offer lower current yields, but they’ll let you sleep at night.

Higher risk tolerance? You might allocate a portion to emerging dividend payers or cyclical industries with higher yields but less certainty.

Age plays a role, but it’s not the only factor. A 35-year-old with three kids and a mortgage might rightfully be more conservative than a 55-year-old with substantial savings and multiple income streams.

The worst mistake? Building a portfolio that exceeds your risk comfort zone. When things inevitably get rocky, you’ll make emotional decisions that destroy your long-term plan.

Match your strategy to your psychological reality, not some ideal investor you think you should be.

Sector diversification strategies

If all your dividend stocks are in one sector — congrats, you’re overexposed. When tech dips, or oil spikes, so does your stress level. That’s why smart investors spread out across sectors.

Early in my dividend game, I was all-in on utilities — safe, stable… until rate hikes hit and my returns flatlined. Lesson learned: sector diversification isn’t optional, it’s insurance.

Mix it up with:

• Consumer staples for consistency

• Financials for yield

• Healthcare for resilience

• Tech for long-term growth

• REITs for real estate flavor

For a solid breakdown of how diversification actually protects your portfolio, check out this guide from Morgan Stanley — simple, strategic, and straight to the point.

Pro tip: Don’t just diversify your companies — diversify the industries they play in. Your portfolio will thank you.

Balancing between high-yield and dividend growth stocks

Here’s the truth: chasing yield alone can lead you into risky territory. But only picking growth names? You might miss out on serious income now. The sweet spot? A portfolio that blends both.

High-yield stocks offer immediate cash flow — ideal if you want to fund your lifestyle or reinvest aggressively. Meanwhile, dividend growth stocks steadily increase payouts, compounding returns over time.

In my own strategy, I keep a 60/40 mix — leaning slightly toward growth stocks for long-term upside, while the yielders keep my passive income flowing.

For a clear side-by-side comparison of these two strategies, check out this breakdown from Starlight Capital — sharp, strategic, and easy to digest.

Pro tip: Let your goals lead. Income now? Favor high-yield. Building wealth? Prioritize growth — then blend smartly.

Dividend Reinvestment Plans (DRIPs)

How DRIPs Accelerate Wealth Building

Imagine this: instead of spending your dividend payout on lunch or a latte, it’s instantly used to buy more stock. No transaction fee, no mental friction. That’s the quiet genius of a Dividend Reinvestment Plan (DRIP).

Back in my early investing days, I cashed out dividends because it felt real. A reward. But once I activated DRIPs? The compounding kicked in. Shares started stacking. Those tiny reinvestments began pulling real weight.

And here’s where it gets good:

- You skip emotional decisions.

- You buy more when prices dip.

- You’re letting time — not timing — build your wealth.

Think of it like planting a money tree. Each dividend reinvestment is another branch. Come a few seasons? You’ve got shade and fruit.

For a beginner-friendly breakdown with real-world context, check out this guide from Moneywise — clear, practical, and packed with tips to get you started.

Bottom line: DRIPs take your passive income and recycle it into future returns. Set it, forget it — and let the magic compound.

Setting Up Automatic Dividend Reinvestment

This is where the real automation magic kicks in. Once you’ve chosen your dividend stocks, enabling automatic reinvestment turns passive income into a compounding machine.

Here’s how it works: your brokerage takes your dividends and buys more shares — automatically. No fees, no hassle, no FOMO. It’s like putting your money on autopilot, except it’s actually working.

I remember toggling that DRIP switch for the first time — felt small, but over time, those reinvested dividends started generating their own dividends. That’s when things got fun.

Depending on your platform (think Fidelity, Schwab, or Robinhood), it usually takes just a few clicks. Want to see how DRIPs function behind the scenes? This Schwab article breaks it down with clarity and precision — a must-read if you’re ready to automate your gains.

Pro tip: Activate DRIPs on long-term holdings. Let your portfolio snowball without needing your daily attention.

When to Reinvest vs. When to Take Cash Dividends

Reinvesting or cashing out? It’s one of the most strategic decisions in dividend investing — and it’s not one-size-fits-all.

Reinvest when:

- You’re focused on long-term growth

- You don’t need the income right now

- You want to compound returns automatically (hello, DRIPs)

Take cash when:

- You’re living off the income (retirement, side hustle mode)

- You’re reallocating funds into other investments

- Market conditions are rocky and you prefer liquidity

Back when I was building my portfolio, every penny got reinvested. But when I took a sabbatical? Those quarterly checks became real-world fuel.

or a solid perspective on when reinvesting makes the biggest impact, check out this article from Investopedia — it’s backed by data and long-term insight.

Pro tip: Let your stage of life, not just your portfolio, determine the right move. Cash is king — but reinvestment builds empires.

Common Dividend Stock Investing Mistakes

Chasing Yield Without Considering Fundamentals

The highest dividend yield doesn’t always mean the best investment. I’ve seen too many beginners make this mistake – swooning over double-digit yields without checking what’s under the hood.

Here’s the truth: abnormally high yields often signal trouble. When a stock price tanks but the dividend amount stays the same, the yield percentage skyrockets. That eye-popping 15% yield? It might be a flashing warning sign that the market expects a dividend cut.

Take 2020 for example. Many investors jumped on energy stocks with 10%+ yields right before they slashed their dividends to zero. Ouch.

Smart dividend investors dig deeper by examining:

Payout ratio: If a company pays more than 70-80% of earnings as dividends, ask yourself: is this sustainable? Different industries have different norms, but extreme payout ratios spell danger.

Earnings trends: Are profits growing, stable, or declining? A company can’t maintain dividend payments if earnings are consistently falling.

Debt levels: Heavy debt + high dividend = recipe for disaster. When cash gets tight, dividends get cut.

Cash flow: Earnings can be manipulated. Cash flow doesn’t lie. Check if the company generates enough cash to cover its dividend payments comfortably.

A solid 3-4% yield from a financially healthy company beats an unstable 8% yield any day. Remember, your goal isn’t just collecting dividends today – it’s building wealth for decades.

Ignoring Dividend Cuts Warning Signs

Here’s the dividend investor’s nightmare: one day, your favorite stock drops a “dividend cut” bomb — and your passive income takes a hit. But cuts rarely come out of nowhere. The warning signs? Always there… if you’re looking.

I once held onto a stock with an 8% yield even after three straight quarters of shrinking earnings and a payout ratio nearing 100%. I ignored the red flags — then came the cut. Lesson learned.

Red flags include:

- Sky-high payout ratios (above 80%)

- Declining cash flow

- Mounting debt

- Executive radio silence on future dividends

For a sharp rundown on spotting trouble before it hits your income, check out this article from Curzio Research — it breaks down key red flags every dividend investor should watch.

Pro tip: Watch management commentary, cash flow trends, and dividend history. If something feels off — it probably is.

Overlooking Tax Implications

Here’s the unsexy truth no one hypes on TikTok: taxes can quietly eat into your dividend returns if you’re not paying attention. And too many investors learn that the hard way.

I used to celebrate every quarterly payout… until tax season slapped me with a surprise. Some of those juicy dividends? Taxed as ordinary income. Others were qualified — lower rate, thank you very much.

To play it smart, you’ve got to know:

- Qualified vs. ordinary dividends

- How your tax bracket impacts returns

- The benefits of tax-advantaged accounts (hello, Roth IRA)

For a detailed look at how your dividends are taxed (and how to lower that bill), check out this guide from NerdWallet — clear, smart, and packed with real numbers.

Pro tip: Keep high-yield, non-qualified dividend stocks in tax-sheltered accounts when possible. That’s how the pros do it.

Failing to Rebalance Your Dividend Portfolio

Even the best dividend portfolio needs a check-up. If you’re not rebalancing regularly, you’re risking drift — where one sector, stock, or strategy starts dominating more than it should.

I once let a single REIT grow into 40% of my holdings during a bull run. Looked great… until rates spiked and my “diversified” portfolio tanked. Now I rebalance every quarter like it’s gospel.

What rebalancing does:

- Keeps sector allocation in check

- Maintains risk tolerance

- Locks in gains, trims overexposure

For a trusted breakdown on when and how to rebalance like a pro, check out this guide from Vanguard — it’s straightforward, strategic, and backed by decades of portfolio wisdom.

Pro tip: Automate your rebalance schedule. Set it, review it, and keep your portfolio aligned with your original goals — not last quarter’s hype.

Practical Steps to Start Your Dividend Investing Journey

A. Opening the right investment account

Ready to dive into dividend investing? First things first – you need the right account. Not all investment accounts are created equal, especially when it comes to dividends.

For most beginners, these are your main options:

Brokerage account: Your standard, flexible investment account. You can buy and sell stocks whenever you want, but you’ll pay taxes on those dividend payments each year.

Roth IRA: My personal favorite for dividend investing. Why? Your dividends grow TAX-FREE. Seriously. Every cent those companies pay you can compound without Uncle Sam taking a cut. The catch? Annual contribution limits ($6,500 in 2023, or $7,500 if you’re over 50) and you can’t touch the money until retirement without penalties.

Traditional IRA: Similar to the Roth, but with tax deductions now and taxes later when you withdraw. Dividends still grow without yearly tax hits.

401(k): If your employer offers one with self-directed investment options, you might be able to focus on dividend stocks here too.

How do you choose? Ask yourself:

- When do I need this money?

- Do I want tax benefits now or later?

- How much control do I want over my investments?

For pure dividend growth that you won’t touch for decades, the Roth IRA is tough to beat. For more flexibility, go with a standard brokerage account.

Popular brokers for dividend investors include Fidelity, Vanguard, Charles Schwab, and newer platforms like M1 Finance that make dividend reinvestment super simple.

B. Research tools and resources for dividend investors

The difference between successful dividend investors and everyone else? Research. You can’t just pick stocks with the highest yields and call it a day.

Here are the tools that will give you an edge:

Free resources:

- Dividend.com: Comprehensive data on dividend stocks, including payout histories and upcoming payments

- FINVIZ: Amazing stock screener that lets you filter for dividend yields, payout ratios, and more

- Yahoo Finance: Old-school but reliable for checking basic dividend metrics

- Company investor relations pages: Go straight to the source for dividend policies and history

Paid services worth considering:

- Seeking Alpha: Premium subscription gives you access to dividend grades, alerts, and expert analysis

- Morningstar: Detailed financial health metrics to ensure your dividend stocks aren’t about to cut payments

- Simply Safe Dividends: Focused entirely on dividend safety scores and portfolio building

The metrics you absolutely need to check before buying any dividend stock:

- Dividend yield (3-6% is the sweet spot for most stocks)

- Payout ratio (under 60% for most industries)

- Dividend growth rate (how fast have they increased payments?)

- Dividend history (look for 5+ years of increases)

- Earnings growth (to support future dividend increases)

Don’t just chase high yields. A company paying a 12% dividend is often signaling trouble, not generosity. Research tools help you see past the headline numbers.

C. Starting with dividend ETFs vs. individual stocks

The biggest question for beginners: Should you start with individual dividend stocks or ETFs?

Dividend ETFs give you instant diversification across dozens or hundreds of dividend-paying companies in one purchase. Individual stocks give you control and potentially higher yields.

Here’s how they stack up:

| Dividend ETFs | Individual Dividend Stocks |

|---|---|

| Instant diversification | Higher potential yields |

| Lower research requirements | More control over holdings |

| Lower overall risk | Customizable income schedule |

| Lower overall yields (typically 2-3%) | Higher research requirements |

| Professional management | No management fees |

For most beginners, I recommend starting with 1-2 dividend ETFs and then gradually adding individual stocks as you gain confidence.

Solid dividend ETFs to consider:

- SCHD (Schwab U.S. Dividend Equity ETF): Focus on quality and growth

- VYM (Vanguard High Dividend Yield ETF): Well-diversified with moderate yield

- DGRO (iShares Core Dividend Growth ETF): Focuses on companies consistently raising dividends

Once you’re comfortable, start adding individual stocks like Johnson & Johnson (JNJ), Procter & Gamble (PG), or Microsoft (MSFT) that have decades of dividend growth.

The best approach? A hybrid method. Use ETFs as your foundation (maybe 60-70% of your dividend portfolio) and add individual stocks for higher yields and specific sector exposure.

D. Creating a regular investment schedule

The secret sauce to dividend investing isn’t picking the perfect stocks – it’s consistency. The most successful dividend investors I know aren’t necessarily the smartest – they’re the most disciplined.

Your best bet? Dollar-cost averaging. This means investing a fixed amount regularly regardless of market conditions.

Why this works especially well with dividend stocks:

- You automatically buy more shares when prices drop

- Your dividend income increases with each purchase

- Market timing becomes irrelevant

- Emotional decisions get removed from the equation

Set up your schedule based on how you get paid:

- Weekly: Great if you can afford it, but transaction costs might be high

- Bi-weekly: Aligns with most people’s paychecks

- Monthly: Most popular and practical for most investors

- Quarterly: Better than nothing, but you’ll miss some buying opportunities

The actual mechanics are simple. Most brokers allow automatic investments on schedule, or you can manually invest the same amount on the same day each period.

Pro tip: Align your investments with dividend payment schedules. Many dividend aristocrats pay in specific quarters, so you can time larger investments right after ex-dividend dates to maximize your long-term return.

And remember – dividend reinvestment is your best friend. Set up DRIP (Dividend Reinvestment Plans) in your brokerage account to automatically buy more shares with your dividends. This compounds your returns dramatically over time.

E. Tracking and measuring your dividend portfolio performance

What gets measured gets managed. If you’re serious about building wealth with dividends, you need to track more than just your account balance.

The metrics that matter most for dividend investors:

Yield on cost (YOC): This shows the current annual dividend divided by your original investment. As companies raise dividends over time, your YOC will increase even if the stock price stays flat. This is perhaps the most satisfying metric to watch grow.

Forward annual income: The total dividends you expect to receive in the next 12 months. This number should increase through additional investments, dividend reinvestment, and dividend raises.

Dividend growth rate: How fast are your holdings increasing their payments? The magic of compounding works even better with growing dividends.

Portfolio yield: Your total expected annual dividends divided by your current portfolio value.

Income diversity: What percentage of your dividend income comes from your top holdings? Ideally, no single company should account for more than 5-10% of your dividend income.

Tools for tracking:

- Spreadsheets: Good old Excel or Google Sheets works great for tracking these metrics

- Portfolio Visualizer: Great for backtesting your strategy

- Stock Rover: Excellent portfolio analysis tools

- DivTracker app: Mobile-friendly dividend tracking

Review your dividend portfolio at least quarterly. Look for:

- Companies that haven’t raised dividends recently

- Payout ratios that are increasing too much

- Sector concentrations that might increase risk

- Opportunities to reinvest larger dividends into underweight positions

Remember – total return still matters. A stock that pays a 3% dividend but grows 7% annually is better than a stock paying 6% that doesn’t grow at all. Don’t get so focused on dividend yield that you ignore the business fundamentals.

The ultimate measure of success? When your dividend income starts covering your monthly expenses. That’s when you’ve achieved the holy grail of dividend investing – financial freedom.

Final Thoughts

Building wealth through dividend stocks requires a strategic approach focused on selecting quality companies with strong fundamentals and consistent dividend histories. By understanding key metrics like dividend yield, payout ratio, and dividend growth rate, you can make informed investment decisions while avoiding common pitfalls such as chasing high yields or neglecting diversification. Dividend Reinvestment Plans (DRIPs) offer a powerful way to compound your returns over time.

Start your dividend investing journey today by educating yourself, setting clear goals, and beginning with a small, diversified portfolio. Remember that dividend investing is a long-term strategy—patience and consistency are your greatest allies. As you grow more comfortable, you can expand your holdings and potentially enjoy both passive income and capital appreciation that can help secure your financial future for years to come. Knowledge compounds too. Keep learning on the Investillect blog.