Ever stood in line for concert tickets you couldn’t afford alone? Crowdfunding for beginners works just like that friend who said, “I’ll chip in $20 if you’re short.” Except now, it’s thousands of strangers online pooling their money to fund everything from indie films to medical bills. This starter guide to crowdfunding shows how collective support can turn bold ideas—or urgent needs—into real-world results.

Fundamentally, crowdfunding has transformed how people raise capital, turning passion projects into funded realities—without traditional gatekeepers like banks or investors saying “no.” As what is collective funding shows, the power now lies with the crowd.

In this guide, I’ll break down exactly how crowdfunding works, which platforms fit your specific needs, and the psychological triggers that make campaigns go viral versus flop miserably. For a deeper dive into the definition and mechanics, check out this comprehensive overview on Investopedia.

But first, let me tell you about the farmer who raised $67,000 in 48 hours for a chicken coop that would change how we think about sustainable agriculture…

Understanding the Basics of Crowdfunding

Definition and Core Concepts of Crowdfunding

Crowdfunding strips away the gatekeepers of traditional finance and puts the power directly in people’s hands. At its core, it’s a funding method where individuals pool their money to support projects, businesses, or causes they believe in.

Think of it as passing the hat around—but on steroids and with the Internet’s reach. Crowdfunding for beginners flips the traditional funding model: instead of convincing one big investor to back your idea, you’re rallying hundreds or thousands of regular folks to chip in smaller amounts.

The four main types you’ll encounter are:

- Reward-based: Back a project and get something in return (like Kickstarter)

- Equity-based: Invest money, own a piece of the company

- Donation-based: Give money to causes with no expectation of return

- Lending-based: Loan money that gets paid back with interest

Ultimately, what makes crowdfunding click is its community aspect. As understanding crowdfunding highlights, it’s not just about the money—it’s about building a league of supporters who become your early adopters, brand ambassadors, and biggest cheerleaders.

How Crowdfunding Differs from Traditional Financing

Traditional financing feels like trying to get into an exclusive club with a strict bouncer. Crowdfunding? It’s more like an open house party where everyone’s invited.

| Traditional Financing | Crowdfunding |

|---|---|

| Requires collateral, credit history | Relies on concept strength and community appeal |

| Typically involves a single source (bank, VC) | Pools small amounts from many individuals |

| Lengthy approval processes | Can launch quickly on platforms |

| Limited to established businesses | Open to startups and creative projects |

| Private transaction | Public campaign with marketing elements |

The biggest difference? With traditional financing, you’re mainly proving financial viability. With crowdfunding, you’re selling a vision that resonates emotionally.

And while a bank loan just gives you money, crowdfunding for beginners shows how you can get funding plus market validation, a customer base, and public exposure. That’s like getting the cake, eating it, and having people post about how great it tastes.

The History and Evolution of Crowdfunding

Crowdfunding isn’t as new as you might think. In 1713, Alexander Pope used subscription funding to translate Homer’s Iliad—essentially an 18th-century Kickstarter for literature.

Historically, the modern crowdfunding we know really took off with the internet. As crowdfunding explained notes, in 2000, ArtistShare became the first dedicated crowdfunding platform, helping musicians fund their albums.

Then came the crowdfunding boom:

- 2005: Kiva launches, pioneering microloans for entrepreneurs in developing countries

- 2008: Indiegogo enters the scene

- 2009: Kickstarter launches, becoming the poster child for reward-based crowdfunding

- 2012: JOBS Act passes in the US, legitimizing equity crowdfunding

- 2016: Regulation Crowdfunding goes into effect, allowing non-accredited investors to participate

Each platform iteration has made funding more democratic and accessible. What started as a fringe funding method has transformed into a mainstream financial tool that’s disrupting venture capital and traditional lending.

Key Statistics That Show Crowdfunding’s Impact

The numbers behind crowdfunding tell a powerful story about its growing influence:

- The global crowdfunding market hit $13.64 billion in 2021 and is projected to reach $25.8 billion by 2027

- Kickstarter alone has funded over 225,000 projects with more than $7 billion pledged

- The average successful crowdfunding campaign raises about $28,656

- Women entrepreneurs often see higher success rates on crowdfunding platforms than through traditional venture capital

- Video content increases a campaign’s chances of success by 66%

What’s really eye-opening is how crowdfunding for beginners highlights the way this model has democratized entire industries. Film projects that would never get studio backing find audiences willing to fund them. Medical patients use crowdfunding to cover treatment costs. And hardware startups use it to prove market demand before approaching larger investors.

The ripple effects go beyond just funding. Crowdfunding has created entire ecosystems of services around campaign creation, marketing, and fulfillment. It’s not just changing how we fund things—it’s changing how we bring ideas to life.

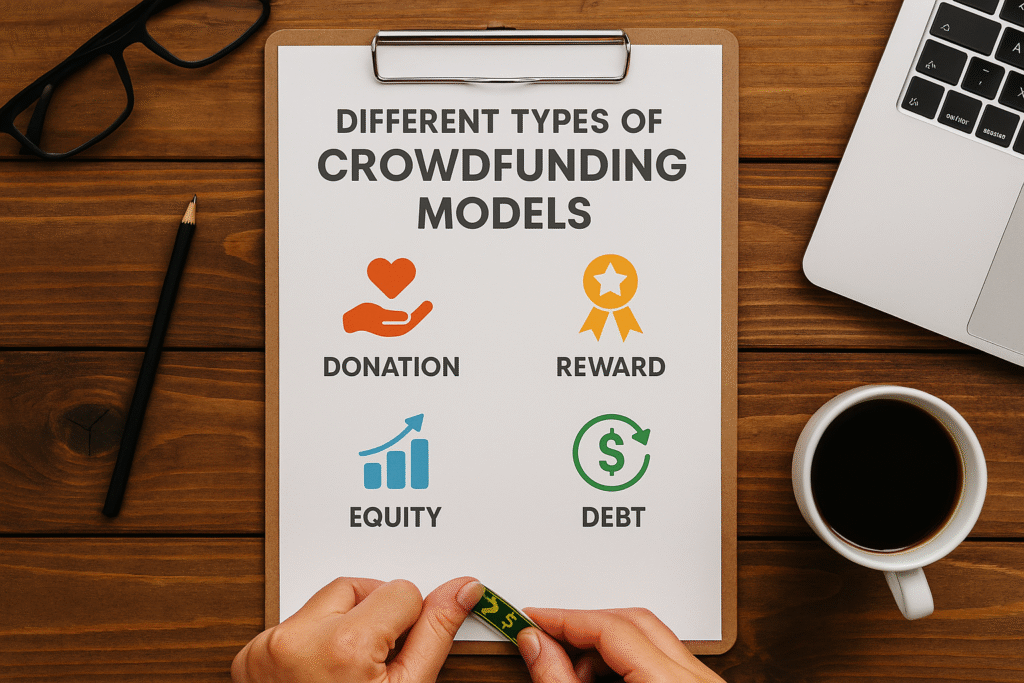

Different Types of Crowdfunding Models

Reward-Based Crowdfunding: Get Products for Your Support

Ever backed a cool gadget on Kickstarter? That’s reward-based crowdfunding in action. You chip in some cash, and in return, you get something tangible – maybe the product itself, exclusive merch, or special perks.

Think of it as pre-ordering something that doesn’t exist yet. The creator says, “Hey, I’ve got this awesome idea, but I need $50,000 to make it happen.” You say, “Cool, here’s $100,” and they say, “Thanks! When it’s done, you’ll get the thing plus this limited edition sticker.”

Essentially, companies like Kickstarter and Indiegogo dominate this space. As any introduction to crowdfunding will tell you, the beauty lies in supporting innovation directly while scoring something unique. The risk? Sometimes projects flop or deliver late. But when they succeed, you’re part of bringing something new into the world.

Equity Crowdfunding: Become a Shareholder

This is where things get serious. With equity crowdfunding, you’re not just getting a t-shirt – you’re buying actual ownership in a company.

Platforms like SeedInvest and Wefunder connect startups with everyday investors who want a piece of the action. Instead of needing millions to invest in the next potential unicorn, you can get started with as little as $100 on some platforms.

The upside? If that tiny startup becomes the next big thing, your investment could multiply. But crowdfunding for beginners also warns: most startups fail, and you could lose everything you put in. Plus, these investments are typically illiquid—meaning you can’t just cash out whenever you want.

Donation-Based Crowdfunding: Supporting Causes You Care About

Sometimes it’s not about getting something back – it’s about giving.

Donation-based crowdfunding powers platforms like GoFundMe, where people raise money for medical bills, disaster relief, or personal emergencies. It’s also how nonprofits fund specific projects or initiatives.

The reward here is purely emotional – the good feeling that comes from helping others. The most successful campaigns tell compelling stories that connect with donors on a personal level.

No investment returns. No products. Just the knowledge that your $20 helped someone in need or supported a cause you believe in. Crowdfunding for beginners makes it clear: sometimes, the reward is simply doing good.

Peer-to-Peer Lending: The Loan Alternative

P2P lending cuts out the middleman (banks) and connects borrowers directly with individual lenders through platforms like LendingClub or Prosper.

As a lender, you’re essentially playing bank – providing loans and collecting interest payments. Borrowers often get better rates than traditional loans, while lenders can earn higher returns than savings accounts.

Conveniently, the platforms handle all the boring stuff like credit checks and payment processing. As crowdfunding basics explain, you can spread your risk by funding small portions of multiple loans instead of putting all your eggs in one basket.

Just remember: unlike bank deposits, these loans aren’t FDIC insured, so there’s real risk involved if borrowers default.

Real Estate Crowdfunding: Investing in Property Collectively

Always wanted to invest in real estate but don’t have millions lying around? Real estate crowdfunding platforms like Fundrise and RealtyMogul let you get started with as little as $500.

These platforms pool investor money to purchase commercial properties, apartment buildings, or development projects. You earn money through rental income (distributed as dividends) and property appreciation.

The big advantage? Access to real estate investments that were previously available only to the wealthy, plus you don’t have to deal with tenants, toilets, or trash. The downside? Fees can eat into returns, and most investments lock up your money for years.

Popular Crowdfunding Platforms You Should Know

Kickstarter: The Creative Project Giant

Ever backed a off-the-wall gadget or indie film that no big company would touch? That’s Kickstarter‘s sweet spot. Since 2009, they’ve helped creators raise over $7 billion across 225,000+ successful projects.

What makes Kickstarter unique, as crowdfunding for beginners explains, is their all-or-nothing model. Either you hit your funding goal completely, or you get zero dollars. Tough? Yes. But it creates urgency and pushes backers to share projects they love.

Specifically, the platform shines brightest for creative projects—think films, games, music, art, and innovative products. As Crowdfunding 101 reminds us, remember the Pebble smartwatch? It raised over $20 million before Apple Watch was even a thing.

Typical fees: 5% platform fee plus 3-5% payment processing. Not cheap, but the exposure can be worth every penny.

Indiegogo: Flexible Funding for Innovators

Kickstarter too rigid for you? Indiegogo offers something different: flexible funding options.

With flexible funding, you keep whatever money you raise, even if you don’t hit your target. Perfect for projects where partial funding still works. Of course, they offer fixed funding too if you prefer the all-or-nothing approach.

Indiegogo also welcomes a broader range of campaigns than Kickstarter, including charity causes and ongoing businesses. Plus, they offer InDemand – a way to continue raising money after your campaign ends.

Another killer feature? Global reach. While Kickstarter has expanded internationally, Indiegogo was built for worldwide campaigns from day one.

GoFundMe: Personal Causes and Emergencies

GoFundMe isn’t about the next cool gadget – it’s about helping real people through real problems.

This platform dominates personal fundraising for medical bills, emergencies, education costs, and community projects. Since 2010, they’ve facilitated over $15 billion in donations across 190+ countries.

Unlike project-based platforms, GoFundMe campaigns often have no end date or specific funding goal. Money comes in continuously and goes directly to the person in need.

Notably, their biggest selling point? No platform fee for personal campaigns in many countries (though payment processing fees still apply). As what is collective funding points out, that means more of each donation actually reaches the person who needs it.

SeedInvest and WeFunder: Equity Crowdfunding Leaders

Want actual ownership in the startups you back? These platforms let everyday people become investors.

SeedInvest and WeFunder pioneered equity crowdfunding after the 2012 JOBS Act finally made it legal. Instead of getting a t-shirt or early product, you get actual shares in the company.

The minimum investments are surprisingly accessible—often starting at just $100–$1,000. But crowdfunding for beginners underscores the catch: these investments are much riskier than traditional stocks or bonds. Most startups fail, taking your investment with them.

The potential upside? Getting in early on the next Airbnb or Uber before they hit the stock market. These platforms have already helped fund companies now worth billions.

Both sites curate their offerings carefully, with acceptance rates under 5% for companies applying to raise funds.

Creating a Successful Crowdfunding Campaign

Setting Realistic Funding Goals and Timelines

Ever notice how some crowdfunding campaigns ask for $10,000 while others aim for $100,000? The difference isn’t just ambition—it’s strategy.

Your funding goal should cover:

- Production costs

- Reward fulfillment expenses

- Platform fees (typically 5-10%)

- Taxes (don’t forget these!)

- A buffer for unexpected costs (at least 10-15%)

Too low, and you’ll run out of money. Too high, and you might not reach your goal at all—especially on all-or-nothing platforms like Kickstarter.

Research similar campaigns in your category. What did they raise? How long did their campaigns run? Most successful campaigns last 30-40 days. Any longer and you’ll lose momentum; any shorter and you might not reach enough people.

Break your timeline into three phases:

- Pre-launch (4-6 weeks): Build audience, create assets

- Campaign (30-40 days): Daily promotion, updates, engagement

- Post-campaign (varies): Delivery, backer communication

Crafting a Compelling Story and Campaign Page

Your campaign isn’t just asking for money—it’s telling a story where backers become heroes.

The best campaigns answer these questions:

- What problem are you solving?

- Why are you the right person/team to solve it?

- Why now?

- How will backers’ contributions make a difference?

Above all, people fund people, not just products. Share your journey, struggles, and passion. As understanding crowdfunding highlights, authenticity matters—backers can smell manufactured enthusiasm from miles away.

Your campaign page should include:

- Clear, benefit-focused headlines

- Scannable sections with visual breaks

- Social proof (testimonials, media mentions)

- FAQ section addressing common concerns

Write in the first person and speak directly to your audience. “You’ll be the first to receive…” hits differently than “Backers will receive…”

Producing an Engaging Video That Converts

I’ll cut to the chase: as crowdfunding for beginners reveals, campaigns with videos raise 4x more than those without. Your video doesn’t need Hollywood production values—but it does need to connect emotionally.

The perfect campaign video:

- Hooks viewers in the first 10 seconds

- Runs 2-3 minutes (longer and you lose viewers)

- Shows your product/project in action

- Features genuine team members (that’s you!)

- Ends with a clear call to action

Skip the elaborate animations and fancy transitions. Instead, focus on good lighting, clear audio, and authentic energy. Smartphone footage with good lighting beats poor studio footage every time.

Structure your video like this:

- Problem (15 seconds)

- Solution—your project (30 seconds)

- How it works/benefits (60 seconds)

- Team introduction (30 seconds)

- Ask and thank you (15 seconds)

Designing Attractive Reward Tiers

Your reward tiers aren’t just “stuff”—they’re experiences that make backers feel special.

Create 5-7 tiers ranging from:

- $1-25: Digital rewards, thank you notes

- $25-50: Early bird product access

- $50-100: Standard product with perks

- $100-250: Deluxe versions, limited editions

- $250+: Premium experiences, bundles

The sweet spot? Most funding comes from the $25-100 range. Make these tiers irresistible.

Add scarcity where it makes sense. “Only 50 available” creates urgency—but only if it’s genuine.

Additionally, think beyond the product itself. What can you offer that costs you little but feels valuable? Behind-the-scenes updates? A virtual meet-and-greet? As crowdfunding for beginners and crowdfunding explained suggest, your time and access to you can be more valuable than physical perks.

Building Your Campaign Team

Running a crowdfunding campaign solo is like trying to push a car uphill alone—possible but painful.

Your ideal team includes:

- Campaign manager (that might be you)

- Content creator (photos, videos, updates)

- Community manager (responds to comments, messages)

- PR person (reaches out to media)

Can’t afford to hire? Recruit friends, family, or passionate fans. Even 2-3 dedicated helpers can transform your campaign results.

Crowdfunding for beginners emphasizes the power of teamwork: set clear roles and responsibilities, and meet regularly during the campaign to troubleshoot issues and celebrate wins.

Create a shared calendar with key dates:

- Content publishing schedule

- Email send dates

- Social media posts

- Live updates or Q&A sessions

The most successful campaigns aren’t solo ventures—they’re community efforts. Build your team before you build your campaign.

Marketing Your Crowdfunding Campaign Effectively

Pre-launch Strategies to Build Anticipation

The magic of a successful crowdfunding campaign happens way before you hit that launch button. Think about it – would you rather walk into a room full of strangers asking for money, or a room full of excited fans ready to back your project?

Start building your audience at least 3-4 months before launch. Create a simple landing page with an email sign-up form and tease what’s coming. Give people a reason to get excited!

Crucially, document your journey through behind-the-scenes content. Show the prototypes, the failures, the late nights—people fund stories and people, not just products. As introduction to crowdfunding resources often stress, authenticity builds trust and emotional investment.

Create a pre-launch email sequence that gradually reveals more details about your project. Try this approach:

- Email 1: Introduce your vision

- Email 2: Share your personal “why” story

- Email 3: Reveal a key feature or benefit

- Email 4: Address potential objections

- Email 5: Final reminder before launch

Consider offering early-bird rewards for those who join your list. Nothing builds anticipation like exclusivity!

Leveraging Social Media for Maximum Reach

Your social strategy can make or break your campaign. But here’s the thing – you don’t need to be everywhere. Pick 1-2 platforms where your ideal backers actually hang out.

According to crowdfunding for beginners, Instagram and TikTok work wonders for visually appealing products. LinkedIn might be your go-to for B2B innovations. Facebook groups can be goldmines for niche communities.

Create shareable content in these formats:

- Short demo videos (30-60 seconds)

- Eye-catching graphics with key stats

- User testimonials from early testers

- Progress updates showing momentum

The algorithm gods favor consistency, so post at least 3-5 times weekly during your campaign. But quality trumps quantity every time.

Join relevant online communities months before launching, but don’t just drop your campaign link and run. Add value, answer questions, become a trusted voice. When launch day comes, these communities will rally behind you.

Collaboration is your secret weapon. Partner with micro-influencers (5K-50K followers) in your niche. They often have higher engagement rates than mega-influencers and won’t break your budget.

Email Marketing Tactics for Crowdfunding Success

Undeniably, email remains the conversion king in crowdfunding. As crowdfunding basics make clear, your list isn’t just a database—it’s your community of potential backers.

Segment your list from day one:

- Early supporters (your “true fans”)

- Industry professionals

- Media contacts

- Friends and family

Each segment needs different messaging. Your mom doesn’t need the same technical specs as an industry expert.

When crafting emails, follow this structure:

- Attention-grabbing subject line (keep it under 50 characters)

- Personal greeting

- Value-first opening

- Clear call-to-action

- P.S. with urgency or bonus

The timing of your emails matters tremendously. Send your launch announcement early in the morning (around 7-8 AM) when inbox competition is low. Follow-up emails perform best mid-week.

Don’t bombard people daily—that’s the fast track to unsubscribes. Instead, focus on campaign milestones:

- Launch day

- 25% funding reached

- 50% funding reached

- Final 48 hours

- Last chance (final hours)

Always include social sharing buttons. Each email should make it dead simple for supporters to spread the word.

Press and Media Outreach Techniques

Getting media coverage isn’t about blasting generic press releases to every outlet you can find. That approach died years ago.

Start by creating a targeted media list of:

- Industry-specific blogs and publications

- Local news outlets

- Podcasts in your niche

- YouTube channels covering similar topics

As crowdfunding for beginners suggests, research each outlet thoroughly. What stories do they typically cover? Who writes about topics similar to yours? Follow these journalists on Twitter and engage with their content before pitching.

Ultimately, your pitch email needs to be short, personalized, and focused on their audience—not you. As entry-level crowdfunding guides often stress, journalists care about one thing: “Will this interest my readers?”

Here’s a framework that works:

- Brief personalized intro (reference their recent work)

- What makes your project newsworthy (why now?)

- Quick outline of the story angle

- Offer exclusive content/interview

- Contact info and press kit link

Timing is critical. Tuesday through Thursday mornings typically yield higher response rates. Avoid Mondays (inbox overload) and Fridays (weekend planning).

Don’t forget alternative media: podcasts can drive serious traffic to campaigns. Prepare a “podcast pitch kit” with suggested talking points to make hosts’ jobs easier.

Legal and Financial Considerations

Tax Implications of Raising Funds

Crowdfunding isn’t free money – sorry to burst that bubble! When you rake in those sweet contributions, Uncle Sam wants his cut too. How your funds get taxed depends on the type of crowdfunding you’re doing.

Reward-based campaigns? Those funds usually count as income. So if you raised $50,000 on Kickstarter to launch your eco-friendly water bottle, that’s taxable income. Ouch.

Equity crowdfunding is a different animal. Here, you’re not receiving income but selling ownership stakes. This isn’t immediately taxable, but you’re diluting your ownership, which has long-term tax implications when you eventually sell or exit.

Donation-based campaigns might qualify as gifts if there’s nothing exchanged, but platforms like GoFundMe aren’t automatically tax-exempt. The IRS doesn’t just hand out free passes.

My advice? Set aside 30% of what you raise for taxes. Better to have a pleasant surprise than a painful bill.

Fulfilling Your Promises to Backers

Breaking promises to your backers isn’t just bad karma – it can land you in legal hot water. Remember that guy who raised millions for a cooler with speakers and then never delivered? Yeah, he got sued.

When someone backs your project, you’re entering a contract. Plain and simple. You promised something, they paid you, now you need to deliver.

What happens if things go sideways? Communication is your lifeline. Most backers understand delays and challenges if you’re transparent. Radio silence? That’s when people get angry and lawyers get involved.

Practically, document everything. Keep receipts, communications with manufacturers, shipping details—all of it. As any starter guide to crowdfunding will tell you, if questions arise later, you’ll need that paper trail.

And please, please build a buffer into your timeline and budget. Everything takes longer and costs more than you think. That’s not pessimism, that’s crowdfunding reality.

Intellectual Property Protection During Crowdfunding

Here’s a scary thought: you post your brilliant invention on Kickstarter, and before you can say “patent pending,” someone in another country is already manufacturing knockoffs.

Crowdfunding makes you vulnerable. You’re essentially broadcasting your idea to the entire world before you’ve even produced it. That’s risky business.

At minimum, crowdfunding for beginners advises filing a provisional patent application before launching. It’s relatively affordable (around $130) and gives you “patent pending” status for a year while you figure out if your idea has legs.

For creative works, copyright applies automatically, but registration strengthens your position if infringement occurs. Trademarks protect your brand name and logo – worth considering if you’re building something with staying power.

NDAs won’t help much with the general public, but use them with manufacturers, designers, and anyone else who sees your product pre-launch.

Remember that intellectual property protection varies internationally. If you’re planning to sell globally (and with crowdfunding, you likely are), research protection options in key markets.

Regulatory Frameworks for Different Crowdfunding Types

Navigating crowdfunding regulations feels like walking through a maze blindfolded. Each type has its own rulebook, and they’re constantly changing.

Reward-based platforms like Kickstarter face the fewest regulations. You’re essentially pre-selling products, so standard consumer protection and fraud laws apply.

Equity crowdfunding? That’s where things get complicated. The JOBS Act opened doors, but with strings attached. Regulation CF lets companies raise up to $5 million annually from non-accredited investors, but you’ll need financial disclosures and to work through authorized platforms.

Regulation A+ allows for mini-IPOs up to $75 million but requires SEC qualification and ongoing reporting. Not exactly a cakewalk.

Importantly, donation-based crowdfunding has its own quirks. Medical campaigns, disaster relief, nonprofit fundraising—each comes with specific regulatory considerations and potential tax implications. As Crowdfunding 101 outlines, knowing these nuances upfront can save you headaches later.

International campaigns add another layer of complexity. What’s legal in the US might violate regulations in the EU, Asia, or elsewhere.

Bottom line: don’t wing it. Budget for legal counsel before launching any crowdfunding campaign. The few thousand dollars you spend upfront could save you tens of thousands in fines or legal battles later.

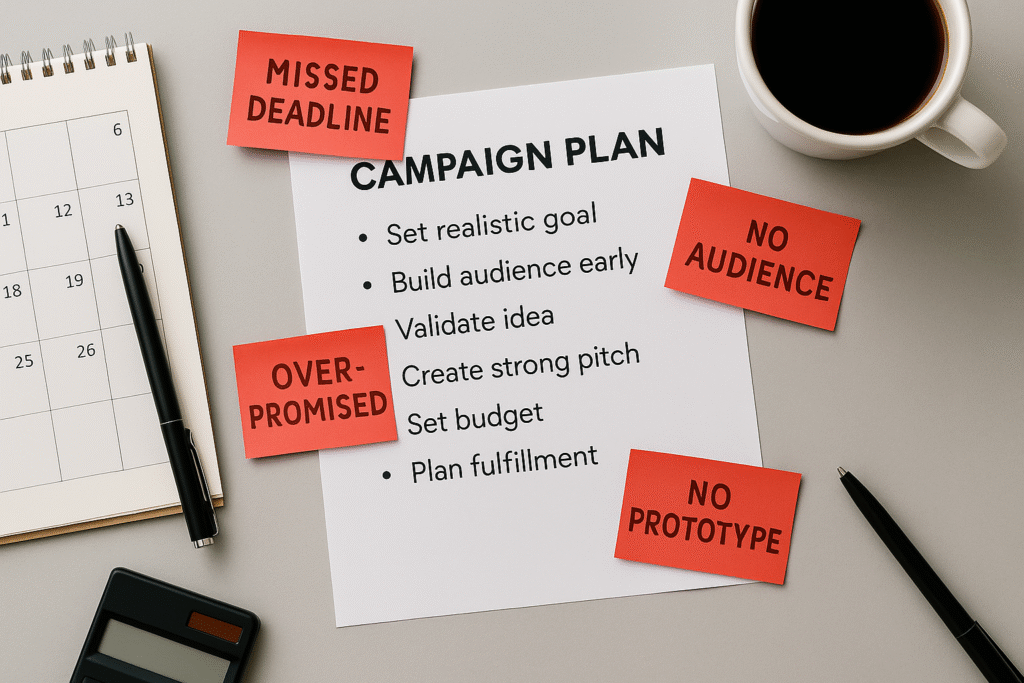

Avoiding Common Crowdfunding Pitfalls

Underestimating Costs and Time Requirements

Crowdfunding isn’t just about posting your idea and watching the money roll in. I’ve seen countless campaigns crash and burn because creators had no clue what they were getting into.

Here’s the brutal truth: whatever budget you’ve calculated? Double it. Whatever timeline you’ve mapped out? Triple it.

Manufacturing hiccups, shipping delays, quality control issues—these aren’t exceptions, they’re the rule. One campaign creator I spoke with budgeted $50,000 for production but ended up spending nearly $85,000 due to unexpected material cost increases and minimum order requirements.

And time? That’s the real killer. A successful tech gadget campaign took 18 months to deliver when they promised 6. By then, many backers had forgotten they even supported the project!

Smart creators build in massive buffers:

- 25-30% extra for manufacturing costs

- 3-4 months padding on delivery timelines

- Emergency fund for the “we never saw that coming” moments

Failing to Build a Community Before Launch

Nobody cares about your crowdfunding campaign. Harsh, but true.

Launching to crickets is the most common killer of campaigns. As crowdfunding for beginners points out, the platforms don’t magically send traffic your way. The most successful campaigns I’ve studied started building their audience 6–12 months before hitting the launch button.

For instance, take the Pebble watch—they didn’t just appear out of nowhere. They had a dedicated following eagerly waiting to back them on day one. That initial surge of backers is what gets you on the “Popular” page, which brings in the strangers. As any collective financing overview will show, momentum is everything in the early hours.

Building a pre-launch community means:

- Growing an email list of at least 1,000 interested people

- Creating social proof with active social media accounts

- Connecting with relevant influencers in your niche

- Testing your messaging before you stake everything on it

Poor Communication with Backers

Your campaign hit its goal! Amazing! Now the real work begins.

The fastest way to turn excited backers into angry internet mobs? Radio silence. I’ve watched creators hide when things get tough, and the backers always assume the worst.

One gaming project raised over $200,000 but imploded when the creator stopped posting updates for three months. Backers filed complaints, demanded refunds, and permanently damaged the creator’s reputation.

The golden rule is simple: communicate early, often, and honestly. Especially when there’s bad news.

Professional creators follow these communication principles:

- Regular updates (at least monthly, weekly during critical phases)

- Immediate disclosure of delays or problems

- Behind-the-scenes content showing actual progress

- Personal responses to backer questions (not copy-paste templates)

Setting Unrealistic Expectations

Overpromising is the silent killer of crowdfunding dreams.

I’ve interviewed dozens of successful campaign creators, and they all say the same thing: the campaigns that fail most spectacularly are the ones that promised the moon.

In truth, that revolutionary tech product that claims to do everything for half the price of competitors? That game promising AAA quality from a tiny indie team? Those impossibly thin wallets that hold 30 cards? As any beginner crowdfunding guide would warn, backers have grown skeptical of these claims—and for good reason.

The most successful campaigns I’ve analyzed do the opposite—they under-promise and over-deliver:

- They focus on doing one thing exceptionally well

- They show working prototypes, not just renders

- They explain limitations honestly

- They set conservative delivery dates they know they can beat

Crowdfunding for beginners makes it clear: when backers receive something better than expected, earlier than promised, they become evangelists for your brand. Miss ambitious targets, and they’ll become your biggest critics.

Success Stories and What You Can Learn From Them

Product Innovations That Went Viral

Remember Pebble? This smartwatch raised over $10 million on Kickstarter back in 2012 when most people hadn’t even heard of crowdfunding. What made it work? They solved a real problem (battery life and smartphone notifications) and showed a working prototype that people could get excited about.

Or take Exploding Kittens, the card game that raised $8.7 million in just 30 days. They didn’t just have a fun concept – they created hilarious videos that people couldn’t help but share. Their updates during the campaign kept backers laughing and spreading the word.

The trick isn’t just having a cool product. It’s showing people why they need it in their lives right now. The most successful campaigns make potential backers think, “Why doesn’t this exist already?” and “I need to tell everyone about this!”

Social Causes That Captured Hearts and Wallets

Notably, the best social campaigns don’t just ask for money—they invite you into a movement. Look at Water is Life, which turned their “Safe Water” campaign into millions of dollars for clean water projects. As Understanding crowdfunding illustrates, they flipped entitlement on its head in a way that made people stop scrolling and pay attention.

Or consider the Bail Project, which raised millions to combat unfair cash bail practices. They succeeded by sharing real stories of people stuck in jail simply because they couldn’t afford bail – making an abstract issue deeply personal.

The winning formula, according to crowdfunding for beginners? Combine emotional storytelling with concrete impact. Show exactly how each dollar changes lives, and create content supporters feel compelled to share with their networks.

Creative Projects That Exceeded Expectations

Amanda Palmer raised $1.2 million for her album when she was only asking for $100,000. How? By building a decade-long relationship with fans before ever asking for money. Her backers weren’t just pre-ordering music – they were funding an artist they already loved.

The “Good Night Stories for Rebel Girls” children’s book started with a $40,000 goal and raised nearly $700,000. The creators tapped into parents’ hunger for inspiring stories about real women for their daughters, filling a gap that traditional publishers had ignored.

These mega-successes share something crucial: they didn’t just meet a need – they created emotional connections that turned backers into evangelists.

How Failed Campaigns Bounced Back Stronger

The first version of Coolest Cooler bombed completely, raising just 1/3 of its goal. However, creator Ryan Grepper didn’t give up. He redesigned the product, launched in summer instead of winter (smart for a cooler!), and created better videos showing the product in action. As Crowdfunding explained shows, his second attempt? $13 million raised—one of the most successful Kickstarters ever.

Crowdfunding for beginners includes cautionary tales like ZPM Espresso, which aimed to create an affordable home espresso machine but ran into manufacturing nightmares after raising $370,000. They eventually had to refund backers—but their failure spotlighted a market gap that companies like Breville later filled successfully.

The comeback stories teach us the most valuable lessons: timing matters, showing beats telling, and sometimes you need to fail publicly before you can succeed spectacularly.

Conclusion

Crowdfunding basics have revolutionized the way individuals and businesses raise capital, offering accessible funding options through various models like donation, reward, equity, and debt-based platforms. Whether you’re launching a creative project, starting a business, or supporting a cause, platforms like Kickstarter, Indiegogo, and GoFundMe provide the infrastructure needed to connect with potential backers. Ultimately, success depends on creating compelling campaigns with clear goals, engaging content, and strategic marketing efforts across multiple channels.

As crowdfunding for beginners emphasizes, embarking on your crowdfunding journey means doing your homework—thoroughly research legal requirements, tax implications, and platform-specific rules. Study both the wins and the wipeouts to refine your approach. With smart planning, authentic storytelling, and relentless promotion, crowdfunding can transform your vision into reality—while building a passionate community that believes in your mission. The power of collective funding awaits. Take that first step today. Keep your momentum going—read more on the Investillect blog.