Have you ever wondered how the government finances its operations or how you can invest in one of the safest securities available? Enter Treasury bonds — the unsung heroes of the financial world. 🏛️💰 In this guide, we’ll break down what Treasury bonds are and why understanding Treasury securities is essential for any smart investor.

These powerful financial instruments play a crucial role in our economy, yet many investors find them shrouded in mystery. Are they truly as safe as everyone claims? How do they work, and more importantly, how can they benefit you? Whether you’re a seasoned investor or just starting to dip your toes into the world of finance, understanding Treasury bonds is essential for making informed investment decisions.

In this comprehensive guide, we’ll demystify Treasury bonds, exploring everything from their basic mechanics to their place in your investment strategy. We’ll dive into the benefits and risks, show you how to buy and sell them, and even touch on current market trends. For a deeper dive into current rates and official information, check out the U.S. Department of the Treasury’s website. So, buckle up as we embark on a journey through the fascinating world of Treasury bonds — your financial knowledge is about to get a serious upgrade! 📈🧠

Understanding Treasury Bonds

Definition and basic concept

Treasury bonds are long-term debt securities issued by the U.S. government to finance its operations. These bonds are considered one of the safest investments due to their backing by the full faith and credit of the United States government. Investors who purchase Treasury bonds are essentially lending money to the government in exchange for regular interest payments and the return of the principal amount at maturity. Understanding what Treasury bonds are is crucial for anyone looking to build a low-risk portfolio with U.S. Treasury securities.

Types of Treasury bonds

There are several types of Treasury bonds, each with different maturities and characteristics:

- Treasury Bills (T-Bills): Short-term securities with maturities of 4, 8, 13, 26, or 52 weeks

- Treasury Notes (T-Notes): Medium-term securities with maturities of 2, 3, 5, or 10 years

- Treasury Bonds (T-Bonds): Long-term securities with maturities of 20 or 30 years

- Treasury Inflation-Protected Securities (TIPS): Securities that protect against inflation

| Type | Maturity | Interest Payments | Inflation Protection |

|---|---|---|---|

| T-Bills | 4-52 weeks | No | No |

| T-Notes | 2-10 years | Semiannual | No |

| T-Bonds | 20-30 years | Semiannual | No |

| TIPS | 5, 10, or 30 years | Semiannual | Yes |

How they differ from other government securities

Treasury bonds differ from other government securities in several ways:

- Issuer: Treasury bonds are issued by the federal government, while municipal bonds are issued by state or local governments

- Risk level: Treasury bonds are considered virtually risk-free, while other government securities may carry some default risk

- Tax treatment: Interest from Treasury bonds is exempt from state and local taxes, but not federal taxes

- Liquidity: Treasury bonds are highly liquid and easily traded in secondary markets

- Yield: Treasury bonds typically offer lower yields compared to corporate bonds or other government securities due to their lower risk profile

Now that we have a solid understanding of what Treasury bonds are, let’s explore the mechanics of how these Treasury securities function in more detail.

The Mechanics of Treasury Bonds

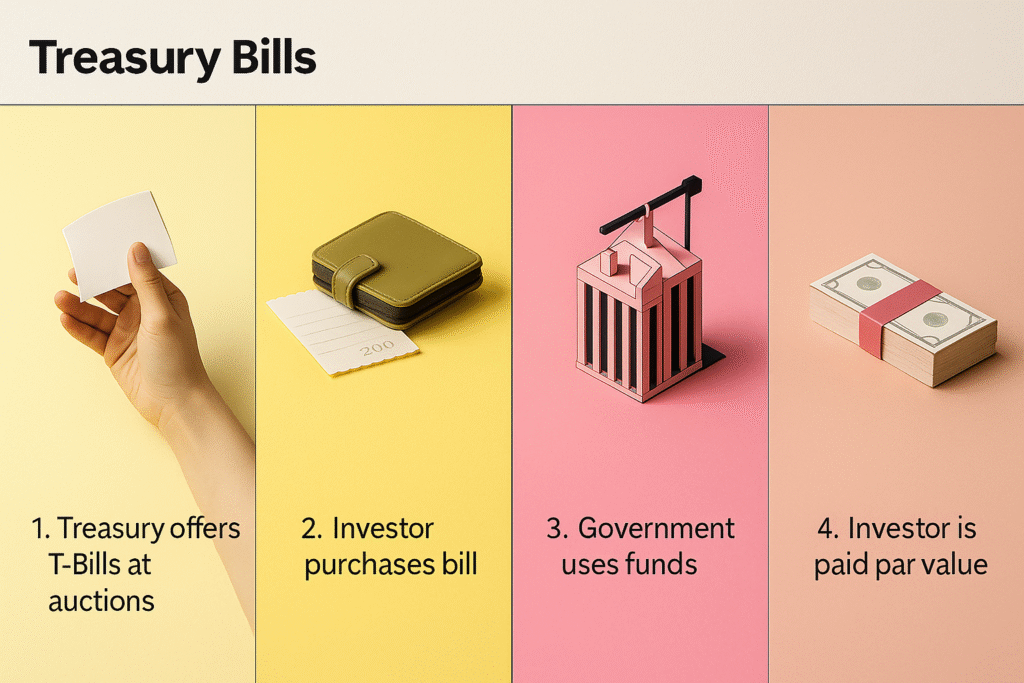

How Treasury bonds are issued

Treasury bonds are issued through a competitive auction process by the U.S. Department of the Treasury. These auctions occur regularly throughout the year, allowing investors to purchase newly issued bonds directly from the government.

- Competitive bidding: Large institutional investors submit bids specifying the yield they’re willing to accept

- Non-competitive bidding: Individual investors can purchase bonds at the average price determined by competitive bids

Maturity periods and interest payments

Treasury bonds come with various maturity periods and interest payment schedules:

| Maturity | Interest Payments |

|---|---|

| 20 years | Semi-annually |

| 30 years | Semi-annually |

Interest payments, also known as coupon payments, are made every six months until the bond reaches maturity.

Face value vs. market price

- Face value: The amount printed on the bond, typically $1,000

- Market price: The current trading price of the bond, which fluctuates based on market conditions

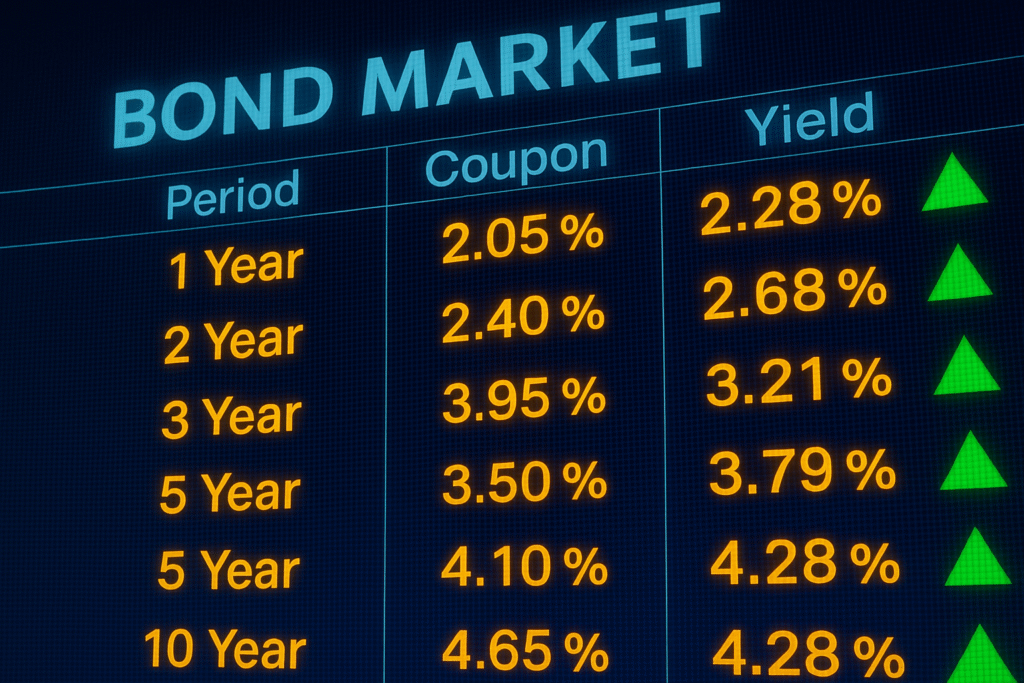

Yield calculation

Yield is a crucial concept in understanding Treasury bond returns:

- Coupon yield: Annual interest rate paid by the bond

- Current yield: Annual interest payment divided by the bond’s current market price

- Yield to maturity: Total return expected if the bond is held until maturity

Now that we’ve covered the mechanics of Treasury bonds, let’s explore the benefits of investing in these government securities.

Benefits of Investing in Treasury Bonds

Safety and security

Treasury bonds are widely regarded as one of the safest investment options available. Backed by the full faith and credit of the U.S. government, they offer unparalleled security for investors. This guarantee ensures that you’ll receive both interest payments and the return of your principal, making them an ideal choice for risk-averse investors. Understanding what Treasury bonds are helps explain why U.S. Treasury securities are a cornerstone of conservative investment strategies. For a comprehensive overview of Treasury bond features and investment tips, check out Investopedia’s guide to Treasury bonds.

Steady income stream

One of the most attractive features of Treasury bonds is their ability to provide a consistent and predictable income stream. Interest payments, known as coupon payments, are typically made semi-annually, offering investors a reliable source of cash flow.

| Feature | Treasury Bonds | Corporate Bonds | Stocks |

|---|---|---|---|

| Income frequency | Semi-annual | Varies | Quarterly (if dividend-paying) |

| Income predictability | High | Moderate | Low |

| Default risk | Extremely low | Varies | N/A |

Tax advantages

Treasury bonds offer unique tax benefits that can enhance your overall returns:

- Interest income is exempt from state and local taxes

- Federal income tax still applies

- Can be used in tax-advantaged retirement accounts for additional benefits

Portfolio diversification

Including Treasury bonds in your investment portfolio can provide:

- Stability during market volatility

- Negative correlation with stocks, offsetting potential losses

- Reduced overall portfolio risk

- Improved risk-adjusted returns

With these benefits in mind, it’s important to consider the potential risks associated with Treasury bonds to make an informed investment decision.

Risks Associated with Treasury Bonds

Interest rate risk

Interest rate risk is a significant concern for Treasury bond investors. When interest rates rise, the value of existing bonds typically decreases. This inverse relationship can lead to potential losses if an investor needs to sell their bonds before maturity. Knowing what Treasury bonds are and how Treasury securities respond to interest rate fluctuations is key to managing this risk effectively.

| Interest Rate Change | Bond Price | Explanation |

|---|---|---|

| Increase | Decreases | New bonds offer higher yields, making existing bonds less attractive |

| Decrease | Increases | Existing bonds become more valuable due to their higher yields |

To mitigate interest rate risk, investors can:

- Diversify their bond portfolio

- Hold bonds until maturity

- Consider shorter-term bonds, which are less sensitive to interest rate changes

Inflation risk

Inflation risk poses a threat to the purchasing power of Treasury bond returns. As inflation rises, the fixed interest payments from bonds may not keep pace with the increasing cost of goods and services.

Key points about inflation risk:

- Erodes real returns over time

- Can lead to negative real yields if inflation exceeds the bond’s interest rate

- Particularly impactful for long-term bonds

Opportunity cost

Investing in Treasury bonds may come with an opportunity cost, especially during periods of economic growth or bull markets in other asset classes. While Treasury bonds offer safety and stability, investors may miss out on potentially higher returns from riskier investments. Understanding what Treasury bonds are can help investors weigh these trade-offs wisely. For insights on where yields might be headed, check out Morningstar’s analysis on U.S. Treasury bond yields.

Factors contributing to opportunity cost:

- Stock market performance

- Real estate appreciation

- High-yield corporate bonds

Investors should carefully weigh the trade-offs between the safety of Treasury bonds and the potential for higher returns in other investments. Understanding what Treasury bonds are and how Treasury securities fit into a diversified portfolio can help investors strike the right balance. Balancing risk and reward is crucial for developing a well-rounded investment strategy.

Buying and Selling Treasury Bonds

A. Direct purchase from the U.S. Treasury

Investors can acquire Treasury bonds directly from the U.S. Treasury through their TreasuryDirect website. This method offers several advantages:

- No fees or commissions

- Competitive yields

- Secure online platform

To purchase Treasury bonds directly:

- Create a TreasuryDirect account

- Fund your account

- Participate in auctions or purchase existing securities

| Feature | Description |

|---|---|

| Minimum purchase | $100 |

| Maximum purchase | $5 million per auction |

| Account types | Individual, business, trust |

B. Through a broker or bank

For those who prefer a more traditional approach, brokers and banks offer Treasury bond purchases. This method may be suitable for investors who:

- Want personalized advice

- Prefer consolidating investments

- Seek additional services

Brokers typically charge fees, but they can provide valuable insights and handle the transaction process.

C. Secondary market transactions

The secondary market offers flexibility for buying and selling Treasury bonds before maturity. Key aspects include:

- Greater liquidity

- Potential for capital gains

- Price fluctuations based on market conditions

Investors can access the secondary market through:

Brokers

| Broker | Key Features | Website |

|---|---|---|

| Charles Schwab | – Access to new issues and secondary market – Robust research tools |

schwab.com |

| Interactive Brokers (IBKR) | – Low trading fees – Extensive fixed-income product access – Transparent pricing |

interactivebrokers.com |

| Fidelity Investments | – Wide Treasury selection – Strong investor education tools – Intuitive platform |

fidelity.com |

Financial Institutions

| Institution | Key Features | Website |

|---|---|---|

| J.P. Morgan Chase | – Primary dealer of U.S. Treasuries – Offers a range of investment services – Access to Treasury auctions and secondary market |

jpmorgan.com |

| Goldman Sachs | – Primary dealer of U.S. Treasuries – Comprehensive investment banking services – Institutional and individual investment options |

goldmansachs.com |

| Bank of America | – Offers Treasury securities through Merrill Lynch – Access to a variety of fixed-income products – Investment advisory services available |

bankofamerica.com |

Bond Dealers

| Dealer | Key Features | Website |

|---|---|---|

| Citigroup Global Markets | – Primary dealer in U.S. Treasuries – Offers broad access to government and corporate bonds – Deep market research and institutional-grade trading tools |

citigroup.com |

| Barclays Capital Inc. | – Major global bond dealer and investment bank – Strong fixed-income capabilities across markets – Active in U.S. Treasury auctions and trading |

investmentbank.barclays.com |

| Jefferies LLC | – Prominent bond dealer for institutional investors – Competitive pricing in fixed-income trading – Well-regarded for market liquidity and client service |

jefferies.com |

When considering secondary market transactions, be aware of:

- Bid-ask spreads

- Transaction fees

- Market volatility

Now that we’ve covered the various methods of buying and selling Treasury bonds, let’s explore how these securities can fit into your overall investment strategy.

Treasury Bonds in Your Investment Strategy

Role in asset allocation

Bonds play a crucial role in asset allocation, providing stability and income to investment portfolios. Understanding what Treasury bonds are helps clarify their importance in creating a balanced mix of investments. These Treasury securities serve as a counterbalance to riskier assets like stocks, helping to reduce overall portfolio volatility. Here’s how bonds fit into different asset allocation strategies:

- Conservative allocation: Higher percentage of treasury bonds (60-80%)

- Moderate allocation: Balanced mix of bonds and stocks (40-60% bonds)

- Aggressive allocation: Lower percentage of treasury bonds (20-40%)

Suitability for different investor profiles

Treasury bonds cater to various investor profiles, each with distinct financial goals and risk tolerances:

| Investor Profile | Suitability | Reasoning |

|---|---|---|

| Retirees | High | Steady income, low risk |

| Young professionals | Low to moderate | Higher risk tolerance, longer time horizon |

| Risk-averse investors | High | Capital preservation, guaranteed returns |

| High-net-worth individuals | Moderate | Portfolio diversification, tax advantages |

Comparison with other fixed-income investments

When considering bonds, it’s essential to compare them with other fixed-income options:

-

Corporate bonds:

- Higher yields but increased risk

- Less liquidity compared to treasury bonds

-

Municipal bonds:

- Tax-free interest income

- Generally lower yields than treasury bonds

-

Certificates of Deposit (CDs):

- FDIC insured up to $250,000

- Often lower yields and less liquidity than treasury bonds

Bonds offer unique advantages in terms of safety and liquidity, making them a valuable component of a well-diversified investment strategy. However, the optimal allocation depends on individual financial circumstances and goals.

Current Market Trends and Treasury Bonds

Impact of economic conditions

Economic conditions play a crucial role in shaping the bond market. Key factors include:

- Inflation rates

- GDP growth

- Unemployment figures

- Consumer confidence

These indicators influence investor sentiment and bond yields. For instance:

| Economic Condition | Impact on Treasury Bonds |

|---|---|

| High inflation | Lower bond prices |

| Strong GDP growth | Higher yields |

| Low unemployment | Decreased demand |

| High consumer confidence | Reduced appeal |

Federal Reserve policies and bond yields

The Federal Reserve’s monetary policy decisions significantly impact US government bond yields:

- Interest rate changes

- Quantitative easing programs

- Forward guidance statements

- Balance sheet management

When the Fed raises interest rates, Treasury bond yields typically increase, affecting their prices inversely.

Global factors affecting Treasury bond markets

International events and trends also influence the government bond market:

- Geopolitical tensions

- Currency fluctuations

- Foreign central bank policies

- Global economic growth patterns

For example, during periods of global uncertainty, investors often gravitate toward U.S. government bonds as a safe-haven asset—pushing prices higher and yields lower. This behavior, commonly referred to as a ‘flight to quality,’ highlights the deep interconnectedness of global financial markets and how they influence the performance of these secure investments.

Final Thoughts

Treasury bonds are a crucial component of the financial landscape, offering investors a secure way to grow their wealth while contributing to government funding. These low-risk investments provide steady income through interest payments and the assurance of principal repayment at maturity. While they may not offer the highest returns, their stability and government backing make them an attractive option for many investors, especially during times of economic uncertainty.

As you consider incorporating government-backed securities into your investment strategy, remember to assess your financial goals, risk tolerance, and current market conditions. Whether you’re looking to diversify your portfolio, generate reliable income, or safeguard your capital, these instruments can play a valuable role in your financial planning. Stay informed about market trends and consult with a financial advisor to make the most of these powerful investment tools.

Ready to go deeper? Tap into the full guide on the Investillect blog.