Ever feel confused by all the forex trading basics and complex terms? You’re not alone. The world of Forex can seem like a maze of jargon and numbers, leaving many new traders overwhelmed and unsure where to start. 🌐💱

But what if you could make sense of forex and start trading without second-guessing every move? Imagine confidently navigating currency pairs, understanding market trends, and making smart trading choices. No matter your level, learning forex basics can lead to real money-making chances.

In this guide, we’ll demystify the Forex market, breaking down key ideas into simple, clear steps. From fundamentals to common pitfalls, we’ll give you the tools you need to begin your forex journey with confidence. Ready to explore the world of currency exchange? Let’s dive in! 🚀💹

Understanding Forex

A. What is forex trading?

Forex trading, short for foreign exchange trading, is the process of buying and selling currencies in the global marketplace. It’s the largest financial market in the world, with an average daily trading volume exceeding $6 trillion. Traders aim to profit from fluctuations in exchange rates between currency pairs.

B. Key players in the forex market

The forex market comprises various participants, each with distinct roles and objectives:

- Commercial banks

- Central banks

- Investment managers

- Retail traders

- Multinational corporations

| Player Type | Primary Role | Example |

|---|---|---|

| Commercial banks | Facilitate currency transactions | JPMorgan Chase |

| Central banks | Implement monetary policies | Federal Reserve |

| Investment managers | Manage forex portfolios | BlackRock |

| Retail traders | Individual speculators | Day traders |

| Multinational corporations | Hedge currency risks | Apple Inc. |

C. Major currency pairs explained

Major currency pairs are the most frequently traded combinations in the forex market. They typically involve the U.S. dollar paired with other strong economies’ currencies:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

D. The role of central banks

Central banks play a crucial role in the forex market by:

- Setting interest rates

- Implementing monetary policies

- Managing foreign exchange reserves

- Intervening in currency markets when necessary

These actions significantly impact currency values and overall market sentiment. Now that we’ve covered the forex trading basics, let’s delve into the specific terminology used in this dynamic market.

Decoding Forex Terminology

A. Pips, lots, and leverage

In the world of forex trading, understanding key terms is crucial. Let’s break down three fundamental concepts:

Pips: A pip (percentage in point) is the smallest price movement in forex trading. For most currency pairs, it’s the fourth decimal place (0.0001).

Lots: A lot is a standardized trading unit in forex. There are three main types:

- Standard lot: 100,000 units of base currency

- Mini lot: 10,000 units

- Micro lot: 1,000 units

Leverage: This allows traders to control larger positions with a smaller amount of capital.

| Leverage Ratio | Initial Deposit | Position Size |

|---|---|---|

| 1:100 | $1,000 | $100,000 |

| 1:200 | $1,000 | $200,000 |

| 1:500 | $1,000 | $500,000 |

B. Long and short positions

When trading forex, you can take two types of positions:

- Long position: Buying a currency pair, expecting its value to increase

- Short position: Selling a currency pair, anticipating its value to decrease

C. Bid, ask, and spread

- Bid: The price at which you can sell the base currency

- Ask: The price at which you can buy the base currency

- Spread: The difference between the bid and ask prices

D. Margin and margin calls

Margin is the amount of money required to open a leveraged position. A margin call occurs when your account balance falls below the required margin level, prompting you to either deposit more funds or close positions.

E. Stop-loss and take-profit orders

These are risk management tools:

- Stop-loss: Automatically closes a trade when the price reaches a specified level to limit potential losses

- Take-profit: Closes a trade when it reaches a predetermined profit level

Understanding these terms is essential for navigating the forex market effectively. Next, we’ll explore how to read currency quotes, which is crucial for making informed trading decisions.

Reading Currency Quotes

A. Base and quote currencies

In the forex market, currency pairs are the foundation of trading. Each pair consists of two components: the base currency and the quote currency. The base currency is the first currency in the pair, while the quote currency is the second. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

Understanding this relationship is crucial for interpreting exchange rates as part of forex trading basics. The rate always shows how much of the quote currency is needed to purchase one unit of the base currency. For instance, if EUR/USD is 1.2000, it means 1 Euro can buy 1.2 US Dollars.

| Currency Pair | Base Currency | Quote Currency |

|---|---|---|

| EUR/USD | Euro (EUR) | US Dollar (USD) |

| GBP/JPY | British Pound (GBP) | Japanese Yen (JPY) |

| AUD/CAD | Australian Dollar (AUD) | Canadian Dollar (CAD) |

B. Direct vs. indirect quotes

Direct and indirect quotes are two ways of expressing currency exchange rates:

- Direct quote: The domestic currency is the quote currency (e.g., USD/JPY for a US trader)

- Indirect quote: The domestic currency is the base currency (e.g., EUR/USD for a US trader)

Understanding these distinctions helps traders interpret rates more effectively and make informed decisions based on their local perspective.

C. Cross rates demystified

Cross rates are currency pairs that don’t include the US Dollar. These pairs are derived from their respective USD rates. For example, to find the GBP/JPY rate:

- Calculate GBP/USD rate

- Calculate USD/JPY rate

- Multiply the two rates

Cross rates offer additional trading opportunities and can be useful for diversifying forex portfolios. They’re particularly important for traders in countries where the local currency isn’t commonly paired with the USD.

Now that we’ve covered how to read currency quotes, let’s explore how to analyze forex market trends to make informed trading decisions.

Analyzing Forex Market Trends

Technical analysis tools

Technical analysis is a crucial skill for forex traders. Here are some essential tools:

- Candlestick charts

- Moving averages

- Relative Strength Index (RSI)

- Fibonacci retracements

- Bollinger Bands

These tools help traders identify trends, support and resistance levels, and potential entry and exit points.

| Tool | Purpose |

|---|---|

| Candlestick charts | Visual representation of price movements |

| Moving averages | Smooth out price data to identify trends |

| RSI | Measure momentum and overbought/oversold conditions |

| Fibonacci retracements | Identify potential support and resistance levels |

| Bollinger Bands | Measure volatility and potential price reversals |

Fundamental analysis factors

Fundamental analysis involves examining economic, social, and political factors that affect currency values. Key factors include:

- Interest rates

- Inflation rates

- GDP growth

- Political stability

- Trade balances

Economic indicators to watch

Traders should monitor these important economic indicators:

- Non-Farm Payrolls (NFP)

- Consumer Price Index (CPI)

- Purchasing Managers’ Index (PMI)

- Gross Domestic Product (GDP)

- Central bank announcements

These indicators provide insights into a country’s economic health and can significantly impact currency values.

Sentiment analysis techniques

Sentiment analysis helps gauge market mood and potential trend shifts. Techniques include:

- Analyzing Commitment of Traders (COT) reports

- Monitoring social media trends

- Tracking institutional investor positions

- Observing retail trader sentiment

By combining technical and fundamental analysis with sentiment indicators, traders can make more informed decisions in the forex market. Next, we’ll explore forex trading strategies suitable for beginners.

Strategies for Beginners

Day trading vs. swing trading

Day trading and swing trading are two popular approaches in forex trading, each with its own advantages and characteristics:

| Aspect | Day Trading | Swing Trading |

|---|---|---|

| Time frame | Intraday | Several days to weeks |

| Number of trades | Multiple trades per day | Fewer trades over time |

| Time commitment | High (constant monitoring) | Moderate (daily analysis) |

| Profit potential | Smaller, more frequent gains | Larger, less frequent gains |

| Risk exposure | Lower overnight risk | Higher exposure to overnight events |

Trend-following strategies

Trend-following strategies capitalize on sustained market movements. Key techniques include:

- Moving Average Crossovers

- Relative Strength Index (RSI)

- Average Directional Index (ADX)

Range trading techniques

Range trading involves identifying support and resistance levels within a currency pair’s price movement. Effective range trading methods include:

- Bollinger Bands

- Stochastic Oscillator

- Fibonacci Retracement

Breakout trading explained

Breakout trading focuses on capturing profits when the price moves beyond established support or resistance levels. Essential components of breakout trading are:

- Identifying key levels

- Confirming the breakout

- Setting appropriate stop-loss and take-profit orders

Risk management principles

Implementing sound risk management is crucial for long-term success in forex trading. Key principles include:

- Setting a risk-reward ratio (e.g., 1:2 or 1:3)

- Using stop-loss orders consistently

- Limiting exposure per trade (e.g., 1-2% of account balance)

- Diversifying currency pairs traded

You’ve learned the basics of forex trading. Now, the next step is finding a broker you can trust. To trade well, you need a platform that’s reliable, easy to use, and fits your style. That’s why choosing the right broker matters.

Choosing a Forex Broker

A. Regulatory compliance and safety

When choosing a forex broker, regulatory compliance and safety should be your top priorities. Also ensure the broker is regulated by reputable financial authorities such as:

- Financial Conduct Authority (FCA) in the UK

- National Futures Association (NFA) in the US

- Australian Securities and Investments Commission (ASIC) in Australia

Regulated brokers adhere to strict financial standards, protecting your funds and personal information. Look for brokers offering segregated accounts, which keep your money separate from the company’s operational funds.

| Regulatory Body | Country/Region | Key Benefits |

|---|---|---|

| FCA | United Kingdom | Strict financial standards, Compensation scheme |

| NFA | United States | Regular audits, Capital requirements |

| ASIC | Australia | Client money protection, Dispute resolution |

B. Forex Trading Platforms and Tools

A robust trading platform is crucial for successful forex trading. Consider the following factors:

- User-friendly interface

- Real-time price quotes

- Advanced charting tools

- Technical analysis indicators

- Mobile trading capabilities

Many brokers offer popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), known for their reliability and extensive features. Some brokers provide proprietary platforms with unique tools and functionalities.

C. Account types and minimum deposits

Brokers typically offer various account types to cater to different trading styles and experience levels:

- Standard accounts

- Mini accounts

- VIP or Professional accounts

Consider the minimum deposit requirements for each account type. Beginners should start with a mini account or a demo account to practice without risking real money.

D. Customer support and education resources

Quality customer support is essential for newcomers to forex trading. Look for brokers offering:

- 24/7 customer service

- Multiple contact methods (phone, email, live chat)

- Support in your preferred language

Valuable educational resources can enhance your trading skills:

- Video tutorials

- Webinars

- E-books

- Trading guides

- Economic calendars

Choose a broker that invests in your growth as a trader through comprehensive educational materials and responsive customer support.

E. Top 5 U.S. Forex Brokers

Trading forex in the U.S. isn’t easy. Rules are strict, and good brokers are harder to find. Planning to trade more, across pairs, or with automation? We’ve found top U.S. brokers that are regulated, low-cost, and easy to use. Here are five of the best:

1. OANDA – Best for Beginners and Casual Traders

OANDA is beginner-friendly with no minimum deposit, tight spreads, and access to MT4 and TradingView. It’s well-regulated and offers strong educational support, making it a solid all-round choice.

2. FOREX.com – Best Overall Broker for US Traders

FOREX.com offers many currency pairs, CFDs, and flexible tools. Ideal for new and skilled traders. Provides solid research and MetaTrader 4 and 5 support.

3. IG US – Best for Pro Tools and Low Spreads

IG offers low-cost trading with spreads from 0.8 pips. U.S. traders get MetaTrader 4, a clean web platform, and strong research—great for those who want pro-level tools and insights.

4. Charles Schwab – Best for Multi-Asset Trading with thinkorswim

Charles Schwab gives traders access to thinkorswim—a platform known for smart charts, custom tools, and deep analysis. You can trade forex, stocks, ETFs, and options in one place, making it a strong pick for active, multi-asset traders.

5. Interactive Brokers – Best for Professional and Institutional Traders

Interactive Brokers is built for serious traders. It offers 100+ markets, low costs, and pro-level tools. It’s harder to begin, yet ideal for active traders.

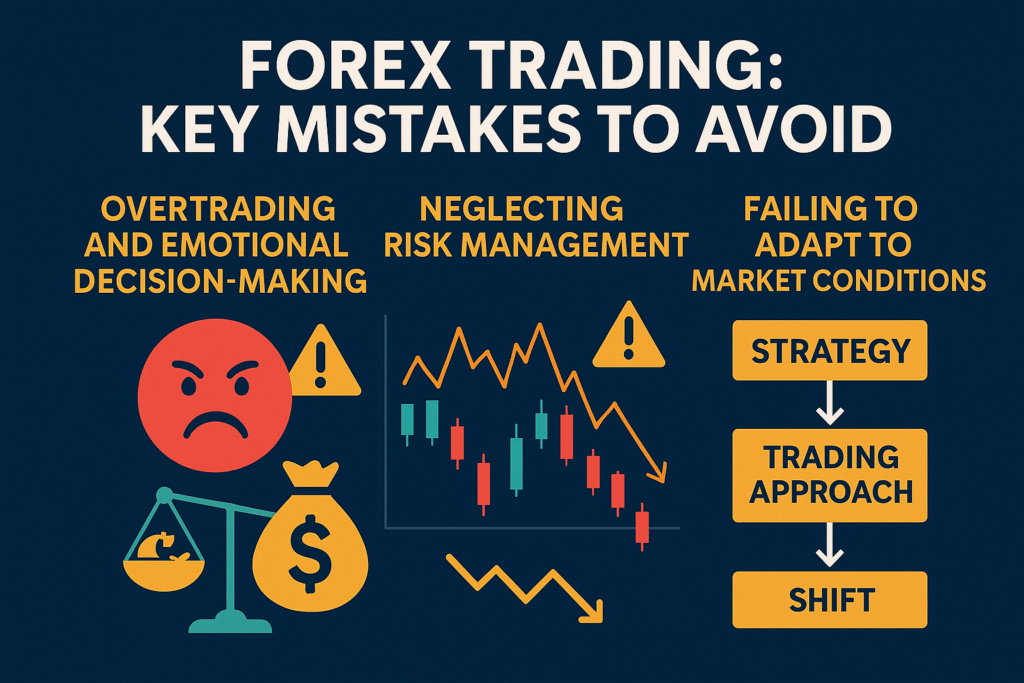

Mistakes Beginners Should Avoid

Overtrading and emotional decision-making

As part of forex trading basics, overtrading and emotional choices are common mistakes—especially for beginners. They may not seem risky. Over time, quick trades often lead to poor decisions and bigger losses. Many traders act out of FOMO or the urge to win back losses. This results in small mistakes which can grow fast. It’s important to stay patient and stick to a clear plan. This can lead to:

- Increased transaction costs

- Higher risk exposure

- Decline in profits

Emotional trading means letting fear, greed, or excitement guide your choices. To avoid these mistakes:

- Develop a solid trading plan

- Stick to your strategy

- Use stop-loss orders

- Take regular breaks

Take the emotions out of decision making, check out Robo-Advisors vs. Traditional Investing: Which is Safer?

Neglecting risk management

Proper risk management is crucial for long-term success in forex trading. Many traders overlook this aspect, leading to significant losses. Key risk management strategies include:

- Setting appropriate position sizes

- Using stop-loss orders consistently

- Diversifying your portfolio

| Risk Management Tool | Purpose |

|---|---|

| Stop-loss orders | Limit potential losses |

| Take-profit orders | Secure profits at predetermined levels |

| Position sizing | Control risk exposure per trade |

Failing to adapt to market conditions

Forex markets are dynamic and constantly changing. Traders who fail to adapt their strategies to current market conditions often struggle. To stay flexible:

- Regularly review and update your trading plan

- Monitor key economic indicators

- Stay informed about global events affecting currency pairs

- Be prepared to adjust your approach based on market volatility

Ignoring global economic events

To start, beginners can use simple strategies. From there, they can build skills, pick a trusted broker, and avoid common mistakes. Neglecting to factor in these events can lead to unexpected losses. To stay informed:

- Follow economic calendars

- Monitor central bank announcements

- Stay updated on geopolitical developments

- Analyze the potential impact of major events on your chosen currency pairs

By avoiding these common mistakes and staying disciplined, traders can improve their chances of success in the forex market. Remember, continuous learning and adaptation are key to navigating the complex world of currency exchange.

Forex Trading Basics: Conclusion

Forex trading offers a world of opportunities for those willing to learn its intricacies. From understanding the forex trading basics to decoding complex terminology, reading currency quotes, and analyzing market trends, mastering the language of currency exchange is crucial for success in this dynamic market. To start, beginners can use simple forex trading basics. From there, they can build skills, pick a trusted broker, and avoid common mistakes.

As you embark on your forex trading journey, remember that knowledge is power. To begin, check out our blog article: How to Start Investing Safely: A Beginner’s Guide. Continually educate yourself, stay informed about global economic events, and practice risk management. With dedication and perseverance, you can navigate the forex market confidently and potentially reap its rewards. Start small, stay disciplined, and let your understanding of the forex trading basics guide you towards becoming a successful currency trader. To deepen your understanding of forex trading, here are some good books to read:

- Currency Trading For Dummies by Paul Mladjenovic , Kathleen Brooks

- Day Trading and Swing Trading the Currency Market by Kathy Lien

- Japanese Candlestick Charting Techniques, Second Edition By Steve Nison